Key Takeaways:

- LetsVenture rebranded to LVX in mid-2025, expanding from early-stage angel funding to full-stack startup support across all growth stages.

- LVX offers four main verticals, including LVX Start for angel funding, LVX Grow for growth-stage capital, LVX School for founder education, and LV Debt for non-dilutive financing.

- The platform connects startups with 14,000+ investors and has helped raise $400+ million across 900+ portfolio companies since inception.

- Early-stage startups benefit most from angel rounds, while growth-stage companies need stronger metrics and governance for larger funding rounds.

- Success on the platform requires a proven business model, clear metrics, and realistic valuations aligned with the market conditions.

Disclaimer: This content is for educational purposes only and should not be considered as financial advice. Every business situation is unique, and we recommend consulting with qualified financial advisors before making important business decisions.

Recent data shows India's startup ecosystem is growing rapidly, with 2,622 startups receiving ₹467.75 crore in funding through various schemes. This expanding support creates more opportunities for entrepreneurs seeking capital at different stages.

With the growing startup ecosystem, there are many funding platforms available for Indian startups today. LetsVenture (now rebranded as LVX) is one of the established players, connecting startups with angel investors since 2013 and facilitating over $400 million in funding across 900+ companies.

In this guide, we cover everything you need to know about LetsVenture, from how it works to what you should consider before applying. So, let’s get into it!

What is LetsVenture (LVX)?

LetsVenture started in 2013 as an angel investment platform founded by Shanti Mohan and Sanjay Jha in Bengaluru. Originally focused on connecting early-stage startups with angel investors, the platform has evolved significantly over the past decade.

In mid-2025, LetsVenture rebranded to LVX to reflect its expanded mission. The company shifted from purely facilitating angel rounds to offering full-stack startup support across the entire business lifecycle, from seed stage to scaling operations.

Let’s see how LVX can actually help you connect with investors.

How Does LetsVenture (LVX) Work?

LVX operates as a curated marketplace connecting vetted startups with accredited investors. The platform uses a multi-step process to ensure quality on both sides.

Here's how the process works for startups:

- Application Submission: Startups apply through LVX's portal, providing detailed business information, financial metrics, and growth projections.

- Due Diligence Review: The LVX team reviews applications, conducting due diligence on business models, market opportunity, and founder backgrounds.

- Platform Listing: Approved startups get listed on the platform, where investors can review opportunities.

- Investor Matching: Investors include angel investors, HNIs, family offices, and venture funds, depending on the funding stage.

- Introduction Management: The platform facilitates introductions and manages the due diligence process between startups and interested investors.

- Deal Support: LVX provides legal framework support for deal closure and offers post-funding support through its various verticals.

Is your business ready for the next level of growth acceleration? S45 partners with established entrepreneurs who want to scale from local leaders to global players. Our founder-first approach goes beyond funding to provide the strategic framework, network access, and operational excellence needed for sustainable growth.

Once you know how LVX works, it’s also essential to know what specific services it offers.

What are LVX's Main Offerings?

LVX organizes its services across four main verticals, each serving different founder and business needs.

- LVX Start: Focuses on early-stage funding through angel investors and seed rounds. This vertical serves founders just starting their journey who need initial capital and market validation.

- LVX Grow: Targets growth-stage companies ready for larger funding rounds. This includes Series A and B rounds from venture funds, family offices, and institutional investors. Companies using this vertical typically have proven product-market fit, recurring revenue, and need capital for market expansion or product development.

- LVX School: Provides educational content and training for both founders and investors. The platform offers courses on fundraising, cap table management, financial planning, and scaling operations.

- LV Debt: Offers non-dilutive financing options for startups that don't want to give up equity. This includes revenue-based financing, working capital loans, and bridge funding. For instance, a profitable SaaS company can use debt financing to fund sales team expansion without diluting ownership.

Each vertical targets different business stages and needs, along with several advantages.

What Do You Get If You Use LetsVenture (LVX)?

LVX offers different benefits for startups seeking funding and growth support. Some of the top advantages include:

- Extensive Investor Network: With 14,000+ investors across angel groups, VCs, and family offices, LVX provides broad market access. This network spans different sectors, funding stages, and geographic regions within India.

- Proven Track Record: The platform has facilitated over $400 million in funding across 900+ startups, closing more than 1,100 deals. This demonstrates both investor confidence and successful deal execution capabilities.

- End-to-End Support: Beyond introductions, LVX provides deal structuring, legal support, and post-funding guidance. Startups don't just get connected — they get supported through the entire funding process.

- Multiple Funding Options: The four-vertical structure means founders can access different types of capital as their needs evolve. A startup might begin with angel funding, progress to growth equity, and supplement with debt financing.

- Educational Resources: LVX School helps founders prepare better for fundraising and scaling. This reduces common mistakes and improves success rates during investor discussions.

- Quality Filtering: The platform's curation process means investors see pre-vetted opportunities, potentially leading to faster decision-making and higher-quality investor relationships.

These benefits are great, but it’s also essential to know whether or not it’s the right solution for your startup.

What Founders Must Consider Before Using LVX?

While LVX offers significant benefits, founders should evaluate several factors before committing to the platform.

- Stage Alignment: Early-stage startups typically find more success with LVX Start, while growth-stage companies need strong metrics for LVX Grow. For a pre-revenue startup, it can be challenging to attract growth-stage investors regardless of platform quality.

- Market Conditions: Funding environments change rapidly. What worked in 2021's funding growth period may not apply in 2025's more selective market. So, it’s essential to have realistic valuations and funding expectations.

- Competition and Differentiation: LVX lists many startups, creating competition for investor attention. Companies need strong value propositions and solid execution metrics to stand out.

- Fee Structure: Like most platforms, LVX likely charges fees for successful funding. Founders should check all costs involved and factor these into their funding calculations.

- Timeline Expectations: Platform-based fundraising typically takes 2-4 months from listing to investor interest. Deal closure requires additional time for due diligence and documentation.

- Alternative Options: Depending on business stage and needs, other funding sources might be more appropriate. Direct investor outreach, accelerators, or strategic partnerships could offer better terms or faster execution.

Many founders find that funding platforms work well for early rounds. But as your business grows, the focus often shifts from raising capital to scaling operations and entering global markets. S45 works with entrepreneurs at this growth stage, who've proven their business model and are ready for exponential growth.

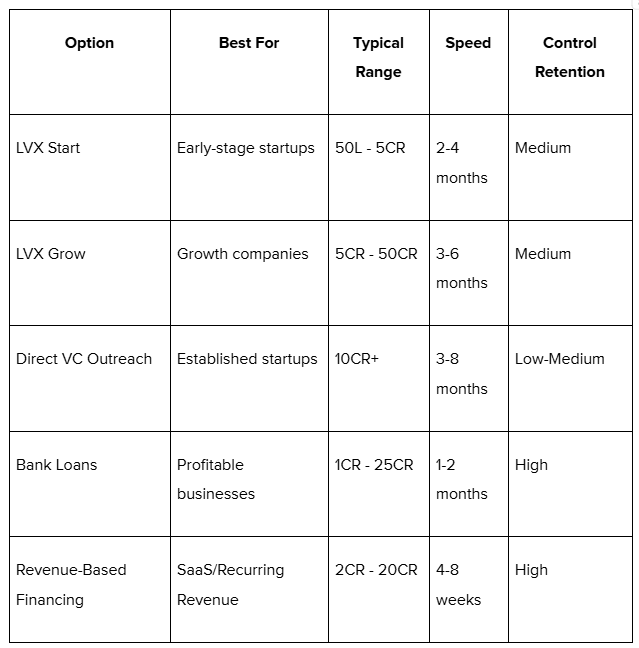

LetsVenture vs Other Funding Options

Comparing LVX to alternative funding sources helps you make informed decisions based on your specific circumstances and growth stage.

Each funding source has different requirements and benefits:

- Direct Investor Outreach: Works well for founders with existing networks or unique market positions. This approach offers more control over the process but requires significant time investment and relationship building.

- Traditional VCs: You get larger funding amounts and strategic value but typically require giving up significant equity and board control. The due diligence process is also more intensive.

- Bank Financing: It preserves equity but requires strong financial performance and collateral. This option works best for established, profitable businesses with predictable cash flows.

- Revenue-Based Financing: This model has gained popularity among SaaS companies and businesses with recurring revenue. Companies pay back investors through revenue sharing rather than equity dilution.

For instance, a profitable e-commerce business generating 25 crores annually might find bank loans more suitable than equity funding, while a tech startup with recurring revenue could benefit from revenue-based financing.

Now that you know what factors to consider, let’s see how you can prepare a strong application that gets investor attention.

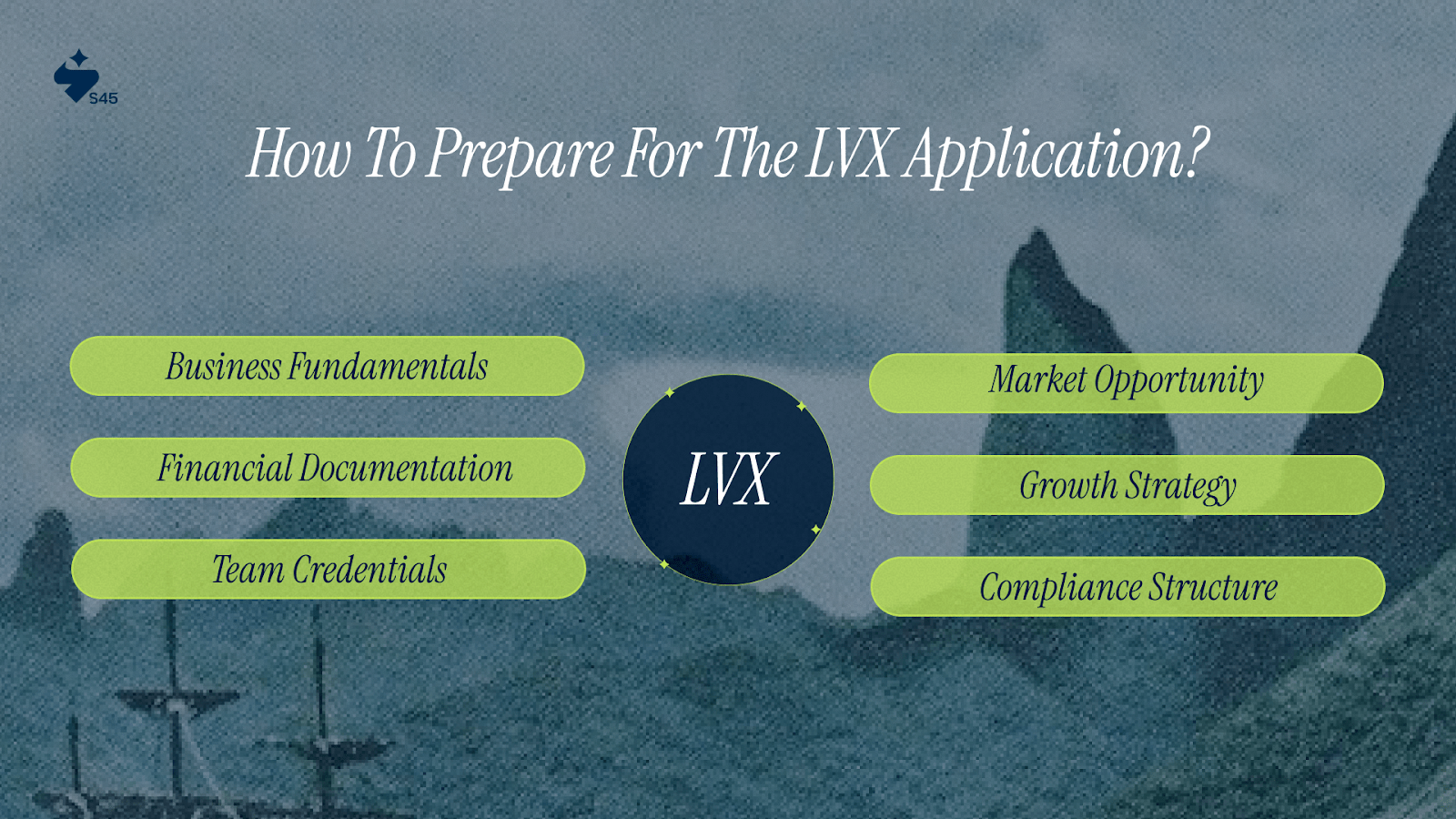

How to Prepare for the LVX Application?

Success on LVX requires thorough preparation across multiple areas that investors will evaluate during their decision process. Some of the effective tips include:

- Business Fundamentals: Clearly articulate your business model, target market, and competitive advantage. Investors need to see how you make money and why customers choose you over alternatives.

- Financial Documentation: Prepare detailed financial statements, projections, and key metrics. For SaaS businesses, focus on MRR, churn rates, and customer acquisition costs. E-commerce companies should highlight GMV, repeat purchase rates, and inventory turnover.

- Team Credentials: Highlight the founder backgrounds, relevant experience, and team capabilities. Investors invest in people as much as ideas, so demonstrate why your team can execute successfully.

- Market Opportunity: Size your addressable market with credible data sources. Show how your solution addresses real customer pain points with evidence from customer interviews or pilot programs.

- Growth Strategy: Outline specific plans for using invested capital. Whether expanding sales teams, entering new markets, or developing products, investors want clear roadmaps with measurable milestones.

- Compliance Structure: Ensure your company has a proper compliance structure, a clean cap table, and necessary documentation. Issues here can delay or derail funding discussions.

Preparation quality often determines application success more than business model innovation. Investors see hundreds of opportunities and quickly identify well-prepared founders versus those still figuring out basic business mechanics.

Scale Your Startup With S45’s Expert Guidance and Support

While platforms like LVX excel at connecting startups with investors, established businesses often need more comprehensive growth acceleration beyond just capital access.

S45 partners with entrepreneurs who've already proven their business model and are ready for hyper-growth. Our founder-first approach recognizes that growing businesses, especially those generating 50+ crores annually with 30%+ growth rates, need strategic frameworks, not just funding introductions.

Our community provides access to:

- Growth Playbooks: Battle-tested strategies for scaling operations, entering new markets, and building sustainable competitive advantages while preserving founder control and company culture.

- Strategic Networks: Connect with like-minded entrepreneurs, experienced mentors, and aligned investors who understand the unique challenges of scaling traditional businesses to global standards.

- Operational Excellence: Frameworks for improving capital efficiency, organizational design, and performance management that enable sustainable growth without sacrificing profitability or founder vision.

- Legacy Preservation: Unlike pure growth-focused platforms, S45 helps founders scale while maintaining the core values and business principles that created their initial success.

- Global Market Access: Support for expanding beyond India into international markets with strategies tailored for businesses with established domestic success.

Whether you're considering LVX for additional capital or looking beyond traditional funding altogether, S45 provides the complete growth acceleration that changes successful businesses into market-leading enterprises.

FAQs

1. What is the minimum investment amount on LetsVenture?

LetsVenture doesn't specify minimum investment amounts as it depends on the startup and funding round. Angel investments typically start from 10 lakhs and above, while growth rounds involve larger ticket sizes from institutional investors.

2. How long does it take to raise funding through LVX?

The process typically takes 2-4 months from application approval to investor interest generation. Deal closure requires additional time for due diligence, term sheet negotiation, and legal documentation completion.

3. What sectors does LetsVenture focus on?

LVX works across multiple sectors, including technology, consumer, D2C, sustainable tech, and spacetech, with digital growth and innovation potential. The platform evaluates for scalability and growth potential, with a strong founding team and proven business models.

4. Can profitable businesses use LetsVenture for growth capital?

Yes, profitable businesses can access growth funding through LVX Grow. Investors often prefer companies with proven revenue models and clear paths to profitability when evaluating larger funding rounds.

5. What documents do I need for the LVX application?

Applications typically require a business plan, financial statements, market analysis, founder backgrounds, legal structure documentation, and detailed use of funds. Specific requirements depend on the funding stage and the amount requested.