Key Takeaways

- Bridging the funding gap – Digital platforms give SMEs faster, easier access to equity, debt, alternative, and public market capital.

- Tailored solutions for every stage – Early-stage businesses benefit from equity platforms; established SMEs can leverage debt or public listings.

- Alternative financing unlocks assets – Platforms like Grip Invest allow SMEs to monetize machinery, inventory, or real estate for growth capital.

- Credibility and visibility matter – Public market platforms like NSE Emerge boost investor confidence and market presence.

- Choose strategically – Align platform type with business stage, funding needs, industry, and regulatory compliance to maximize growth.

- S45 Club edge – Curated equity deals, strategic guidance, and founder-first support accelerate SME growth effectively.

Are you an SME (Small and Medium Enterprises) owner struggling to find the right investment platform to grow your business?

SMEs play a crucial role in India’s economy, contributing significantly to GDP and creating millions of jobs. Yet, accessing structured funding and strategic investment opportunities remains a challenge for many businesses.

Digital investment platforms have emerged as powerful tools to bridge this gap. They offer a variety of solutions tailored to different business needs, from equity funding through angel investors and venture capitalists, to debt financing for quick working capital, alternative investments backed by tangible assets, and even public market listings.

With numerous options available, selecting the right platform can be overwhelming. This blog offers a comparative analysis of the top investment platforms for Indian SMEs, providing insights to inform your decisions, secure the right funding, and scale your business effectively.

Why Investment Platforms Are Essential for Indian SMEs

SMEs are the backbone of India’s economy, contributing approximately 30% to the nation's GDP and accounting for about 45% of total exports. Despite their significant role, SMEs often face challenges in accessing formal financing. According to recent reports, less than 14% of Indian SMEs have access to formal credit, with many relying on informal sources for their financial needs.

This limited access to formal finance hampers the growth potential of SMEs, restricting their ability to invest in technology, expand operations, and hire skilled labor. Investment platforms tailored for SMEs can bridge this gap by providing easier access to capital, reducing dependency on traditional banking systems, and offering more flexible funding options.

Categories of Investment Platforms for SMEs

SMEs in India have diverse funding needs depending on their stage, industry, and growth objectives. To cater to these needs, several categories of investment platforms have emerged, each offering distinct advantages:

1. Equity Investment Platforms

These platforms help SMEs raise capital by offering equity stakes to investors such as angel investors, venture capitalists, and private equity firms. They are ideal for early-stage or high-growth businesses. Key features include:

- Matching SMEs with potential investors based on business model and growth potential.

- Providing tools for company valuation and investment analytics.

- Offering access to pre-IPO or growth-stage investment opportunities.

- Helping secure strategic mentorship alongside capital.

2. Debt Financing Platforms

Debt financing platforms provide structured loans, credit lines, or invoice discounting services for SMEs. They are suitable for businesses needing working capital or expansion funding without giving up equity. Key features include:

- Quick, collateral-free loans using technology-driven credit assessments.

- Flexible repayment terms tailored to cash flow cycles.

- Reduced documentation compared to traditional banks.

- Short-term and long-term financing options for different needs.

3. Alternative Investment Platforms

These platforms offer SMEs access to non-traditional funding avenues such as real estate-backed investments, asset-backed financing, and commodities. They are particularly useful for businesses with tangible assets. Key features include:

- Allowing investors to fund projects through asset-backed investments.

- Providing secured investment opportunities for risk-averse investors.

- Diversifying funding sources beyond traditional equity or debt.

- Supporting SMEs in monetizing existing assets for growth capital.

4. Public Market Platforms

Public market platforms, such as SME exchanges under NSE Emerge or BSE SME, enable businesses to raise capital by listing publicly. They are suitable for established SMEs seeking broader investor access. Key features include:

- Enhancing visibility and credibility in the market.

- Allowing investors to buy and trade shares provides liquidity.

- Offering regulated and transparent fundraising mechanisms.

- Supporting growth and expansion through access to a large pool of public investors.

By understanding these categories and their unique features, SME owners can select the investment platform that best aligns with their growth strategy and funding requirements.

Comparative Analysis of Leading Platforms

Following the comparative analysis of leading platforms, it's important to understand the distinct advantages each platform offers to SMEs and investors.

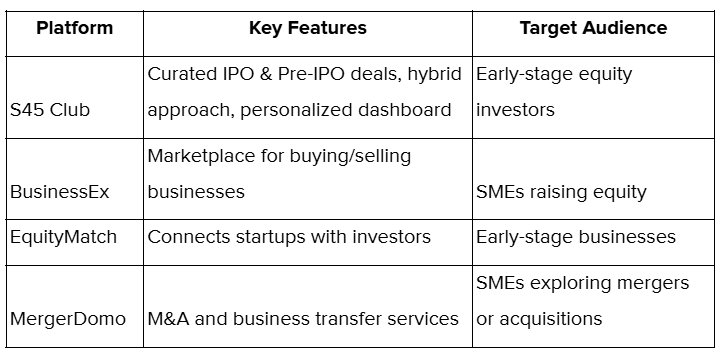

1. Equity Investment Platforms

Equity investment platforms connect startups and SMEs with investors, providing opportunities to raise capital and grow. These platforms also give investors access to curated deals and wealth-creating opportunities.

S45 Club partners with high-growth SMEs, providing investors access to curated IPO and pre-IPO equity opportunities. The platform combines innovation, transparency, and advisory support to make equity investing seamless and impactful.

- BusinessEx

BusinessEx is an online interactive platform that connects businesses, startups, investors, mentors, lenders, incubators, and brokers across industries and geographies. It offers a marketplace for buying and selling businesses, facilitating the promotion of investment opportunities, and gaining expertise from renowned mentors in a secure environment.

- EquityMatch

EquityMatch is a global platform designed to empower founders by connecting them with investors. It aims to help users create wealth and achieve their financial goals by providing access to the best wealth-creating opportunities worldwide.

- MergerDomo

MergerDomo is India's leading M&A and fundraising platform, specializing in mergers, acquisitions, and business transfers. It assists SMEs in finding suitable investors or buyers and offers expert consulting services for valuation, due diligence, and M&A readiness.

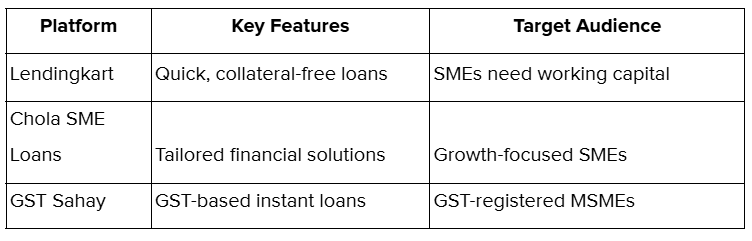

2. Debt Financing Platforms

Debt financing platforms help SMEs access quick, collateral-free loans and structured credit solutions. They are designed to meet working capital needs and support business growth.

- Lendingkart

Lendingkart offers working capital loans to SMEs using technology-driven credit assessment. It provides quick disbursal of funds without collateral, focusing on current cash flows and business growth rather than past records.

- Chola SME Loans

Chola offers SME loans ranging from ₹10 lakhs up to ₹5 crores, providing tailored financial solutions for business expansion and asset acquisition. It offers flexible loan tenures and rapid disbursal to meet the diverse funding needs of SMEs.

- GST Sahay

GST Sahay is a digital lending program offering instant working capital loans to GST-registered MSMEs. It utilizes GST returns for credit assessment, ensuring quick and collateral-free loans.

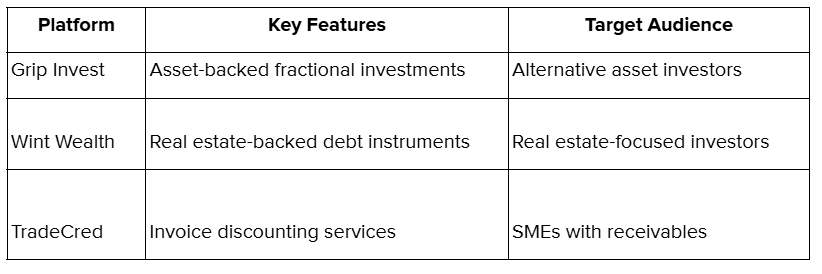

3. Alternative Investment Platforms

These platforms provide innovative ways for investors to diversify their portfolios. SMEs benefit from alternative financing models, while investors gain access to fractional, secured, or invoice-backed assets.

- Grip Invest

Grip Invest allows SMEs to raise funds through asset-backed investments. Investors can invest in fractional ownership of assets, earning fixed returns ranging from 10% to 14% per annum.

- Wint Wealth

Wint Wealth provides investment opportunities in secured debt instruments, focusing on real estate-backed investments for SMEs. It offers fixed returns ranging from 9% to 12% per annum and is regulated by SEBI.

- TradeCred

TradeCred offers invoice discounting services, enabling SMEs to unlock working capital by selling their invoices at a discounted rate. It connects SMEs with institutional investors for short-term financing.

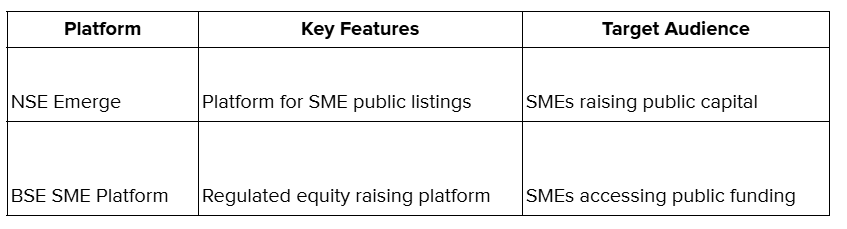

4. Public Market Platforms

Public market platforms provide SMEs with access to equity capital through regulated exchanges. They enhance credibility, visibility, and investor trust while opening doors to large-scale growth opportunities.

- NSE Emerge

NSE Emerge is a platform for SMEs to list and raise capital through public offerings. It provides visibility and credibility to listed SMEs, helping them grow and expand by connecting them with a larger pool of investors.

- BSE SME Platform

The BSE SME Platform offers a regulated environment for SMEs to raise equity capital. It provides opportunities for investors to invest in high-growth SMEs, facilitating access to the capital markets while ensuring compliance with financial regulations.

Factors to Consider When Choosing an Investment Platform

Selecting the right investment platform is critical for SMEs to secure funding effectively and support their growth objectives. Here are the key factors to consider:

- Business Stage: Early-stage SMEs may benefit more from equity investment platforms that connect them with angel investors and venture capitalists who can provide strategic guidance. Established SMEs might prefer debt financing or public market platforms to raise larger amounts of capital without diluting ownership.

- Funding Requirements: Equity financing is suitable for businesses looking to raise capital in exchange for a share of ownership. Debt financing allows SMEs to access working capital or expansion funds without giving up equity. Alternative investments provide flexible funding options backed by tangible assets, suitable for businesses with monetizable resources.

- Industry Sector: The choice of platform may depend on the industry. For example, tech startups may attract venture capital and pre-IPO equity deals, while manufacturing or real estate SMEs might benefit more from debt or asset-backed platforms.

- Geographical Reach: Consider whether your business operates locally, nationally, or internationally. Some platforms specialize in connecting SMEs with investors within specific regions, while others provide access to a broader, nationwide investor base.

- Regulatory Compliance: Ensure the platform adheres to relevant regulations, including SEBI guidelines for equity and public listings, and RBI norms for debt financing. Compliance ensures security, transparency, and protection for both SMEs and investors.

By carefully evaluating these factors, SME owners can select the most suitable investment platform, align it with their growth strategy, and maximize their funding opportunities.

Listen Next: Here’s a Podcast on Investment Strategies

If you’d like to explore this topic further, we recently discussed it in detail on our podcast.

Introducing S45: Fueling SME growth with Capital, Governance and Scale

In this video, co-founders Deepank Bhandari and Pankaj Harlalka explain the vision behind S45, their mission to close gaps in India’s capital market, and how the platform supports growth-stage entrepreneurs with structured funding through IPOs, strategic partnerships, and founder-friendly capital solutions.

Why Watch?

- Gain insights into how India’s emerging MSMEs can access capital markets.

- Discover how S45 blends capital strategy, IPO expertise, and operational support.

- Hear firsthand experiences from founders who have scaled businesses while facing funding challenges.

Who Is This For?

- Founders preparing for their next growth phase

- Financial operators and advisors

- Investors seeking profit-driven opportunities

- CXOs assessing IPO-readiness in India

Final Thoughts

Each investment platform offers unique advantages tailored to the diverse needs of Indian SMEs. Equity platforms like S45club provide curated IPO and pre-IPO opportunities, debt platforms such as Lendingkart offer quick and flexible financing, alternative platforms like Grip Invest unlock asset-backed funding, and public market platforms like NSE Emerge enable broader investor access and enhanced credibility. Choosing the right platform requires assessing your business stage, funding needs, industry sector, and growth objectives to ensure strategic alignment and maximum impact.

For SMEs ready to scale and accelerate growth, exploring these platforms can unlock the necessary capital and support. Partnering with S45club, in particular, provides access to exclusive equity opportunities, strategic guidance, and a founder-first approach designed to help your business thrive. Visit S45club to take the next step toward growth and expansion.

Frequently Asked Questions

1. How do equity investment platforms help SMEs?

Equity platforms connect SMEs with investors such as angel investors, venture capitalists, and private equity firms, offering funding in exchange for a stake in the company.

2. What are debt financing platforms, and how do they work?

Debt platforms provide loans, credit lines, or invoice financing, allowing SMEs to raise capital without giving up equity. These platforms often offer faster approvals and flexible repayment options.

3. What are alternative investment platforms?

These platforms offer non-traditional funding options, such as asset-backed financing or real estate-backed investments, enabling SMEs to leverage tangible assets for capital.

4. How can SMEs raise capital through public market platforms?

Public market platforms, like NSE Emerge or BSE SME, allow SMEs to list publicly, access a large pool of investors, and enhance credibility and visibility in the market.

5. How should SMEs choose the right investment platform?

SMEs should consider factors such as business stage, funding requirements, industry sector, geographical reach, and regulatory compliance before selecting a platform.