Alternative investments for high-net-worth individuals are no longer niche, they're becoming essential. India's HNWI population surged 6% in 2024 to reach 85,698, and could climb further to 93,753 by 2028.

As traditional asset classes come under pressure, savvy investors are turning to private equity, real estate, commodities, and private debt.

If you're ready to strengthen your wealth strategy, the real question is not whether alternative investments should be part of your portfolio, but how quickly you can make them work for your goals.

Key Takeaways

- Alternative investments like private equity, hedge funds, and real estate offer higher returns and diversification.

- HNWIs in India are using alternatives to grow wealth, focusing on private equity, real estate, and commodities.

- Types include private equity, venture capital, REITs, InvITs, hedge funds, art, and cryptocurrency.

- Alternatives help manage risk and hedgev against market volatility but need careful planning and expert advice.

What are Alternative Investments for High Net Worth Individuals?

Alternative investments, including private equity, hedge funds, real estate, commodities, venture capital, art, and cryptocurrency, fall outside traditional asset classes like stocks, bonds, and cash.

For India’s HNWIs, who saw wealth grow by 8.8% in 2024 to reach ₹125 lakh crore, these assets offer diversification, higher returns, and reduced market correlation.

This makes them an attractive option for wealth creation and preservation, further cementing India’s position as one of the fastest-growing wealth hubs globally, surpassing economies like China.

Why Are Alternative Investments Popular Among Indian HNWIs?

For HNWIs in India, alternative investments are becoming increasingly attractive due to:

- Private Equity: Opportunities to invest in high-growth startups in sectors like technology, healthcare, and renewable energy.

- Real Estate: Investing in commercial properties, luxury residential units, and Real Estate Investment Trusts (REITs), particularly in metropolitan cities like Mumbai and Delhi, offers both capital appreciation and rental income.

These alternatives not only provide diversification but also help hedge against market volatility, enabling investors to secure and grow their wealth beyond conventional investment options.

Now, let’s look at the different types of alternative investments available in India and how they cater to the specific needs of HNWIs.

Types of Alternative Investments in India for HNWIs

Alternative investments provide high-net-worth individuals (HNWIs) in India with avenues to diversify their portfolios, manage risk, and potentially enhance returns. Below is an overview of 1. Private Equity (PE) and Venture Capital (VC)

- Private Equity: Involves investing in established, unlisted companies with the goal of growth or restructuring.

- Venture Capital: Targets early-stage startups with high growth potential. Indian venture capital firms are increasingly establishing offices in GIFT City to capitalise on global investment opportunities.

2. Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs)

- REITs: Allow investors to pool funds for investing in income-generating real estate assets. Brookfield India REIT's ₹1,000 crore preferential issue exemplifies institutional interest in this sector.

- InvITs: Similar to REITs, but focus on infrastructure projects such as roads and power. The government's proposal to increase institutional investment in InvITs aims to boost capital inflows into the infrastructure sector.

3. Hedge Funds

Hedge funds pool capital from accredited investors and employ strategies such as long-short equity, arbitrage, and derivatives to target high returns.

These funds diversify across equities, bonds, and commodities, with Indian HNWIs focusing on sectors like technology, healthcare, and infrastructure. While offering high-reward potential, hedge funds are high-risk and require longer investment horizons.

- Utilise advanced strategies, such as long-short equity and arbitrage, to generate returns.

- Focus on high-growth sectors, including technology, healthcare, and infrastructure.

- High-risk nature, suited for accredited investors only.

- Require a long-term commitment to fully realize returns.

- Provide diversification and can reduce correlation with traditional asset classes.

4. Commodities

Indian HNWIs favour commodities like gold, agricultural products, and energy assets for diversification and inflation protection.

Gold, in particular, remains a top alternative investment due to its cultural significance as a store of wealth. As of August 7, 2025, gold prices surged to ₹1,02,700 per 10 grams, driven by rising demand during the festive season.

This uptick is also attributed to global economic uncertainties and a weakened rupee, which are prompting more investors to turn to gold ETFs and physical gold to protect their portfolios from inflation and market volatility.

Agricultural and energy commodities also provide opportunities linked to India’s market growth and global demand, typically accessed via futures contracts and ETFs.

5. Art and Collectables

Investing in art and collectables provides HNWIs in India with diversification and wealth preservation. Fine art, antiques, and rare items often appreciate over time, offering both aesthetic appeal and protection against inflation and market volatility.

In March 2025, M.F. Husain’s 1954 painting Untitled (Gram Yatra) sold for a record ₹118 crore at a Christie's auction, highlighting the growing demand for Indian art globally.

- Fine Art: Works by renowned artists have experienced significant appreciation, offering long-term growth potential.

- Antiques: Rare antiques and vintage items are increasingly sought after for both cultural and investment value.

- Collectables: Items such as vintage cars, watches, and wine provide diversification, with potential for high returns.

6. Cryptocurrency

Cryptocurrencies like Bitcoin and Ethereum are gaining popularity among Indian HNWIs for their high return potential and blockchain technology. While offering diversification into a global, decentralized asset class, they come with high volatility and regulatory risks.

Despite this, Indian investors are increasingly using cryptocurrencies as a hedge against traditional market risks and to explore speculative opportunities.

- Bitcoin and Ethereum: The leading cryptocurrencies that offer significant growth potential but also volatility.

- Altcoins: Lesser-known digital currencies, such as Solana and Binance Coin, offer additional speculative opportunities.

- Blockchain: The emerging technology behind cryptocurrencies is reshaping global financial systems, attracting tech-savvy investors.

It’s also crucial to have a clear approach to selecting the right strategy based on your unique financial goals and risk profile

How to Choose the Right Alternative Investment Strategy

Incorporating alternative assets into your portfolio can enhance returns, reduce risk, and act as a hedge against inflation. Here’s a structured approach to making the right choices:

1. Diversify Across Multiple Asset Classes

Diversification across multiple asset classes, such as private equity, hedge funds, commodities, and real estate, helps mitigate risk and smooth returns.

These assets often perform differently from traditional equities and bonds, providing more stable, risk-adjusted returns.

Key Insights:

- Private Equity & Hedge Funds: Offer non-correlated returns compared to traditional assets.

- Real Assets: Provide inflation protection, especially in real estate and commodities.

- Alternative Assets: Assets such as fine wine or digital assets offer growth that is not aligned with global stock markets.

2. Engage Financial Experts for Guidance and Due Diligence

Alternative investments are often more complex and less transparent than traditional assets. Engaging financial advisors ensures thorough due diligence on the asset’s structure, governance, and risk.

Key Insights:

- Expert Guidance: Consult with advisors who specialise in alternatives for nuanced insights. Advisors can also help identify opportunities, like private equity and real estate, that align with your goals.

- Due Diligence: Ensure transparency, strong governance, and clearly defined exit strategies.

3. Continuously Monitor and Adjust Your Allocations

The market for alternative investments is dynamic, making constant monitoring essential. Utilise platforms equipped with advanced tools to track performance in real-time and adjust your portfolio as necessary.

This is particularly important for digital assets, where regulatory and technological changes occur rapidly.

Key Insights:

- Real-Time Tracking: Utilize platforms with blockchain analytics for comprehensive portfolio monitoring.

- Regular Adjustments: Reassess allocations periodically to reflect market shifts or performance changes.

4. Account for Geographic and Sector-Specific Risks

Regional economic conditions and sector-specific risks must be considered when diversifying your portfolio.

Political instability, economic downturns, or industry-specific shifts can significantly impact the performance of real estate or commodities, making it crucial to understand these factors.

Key Insights:

- Geographic Diversification: Spread investments across multiple regions to protect against localised risks.

- Sector Focus: Stay informed about global trends and their impact on key sectors such as energy, technology, and commodities.

5. Tailor Investments to Your Risk Tolerance and Liquidity Needs

Your risk tolerance and liquidity needs should dictate how much you allocate to alternative investments.

High-risk options, such as venture capital, may yield high returns but require longer timelines, while more liquid assets, like commodities, may suit those seeking quicker returns.

Key Insights:

- Risk Assessment: Balance higher-risk investments with stable, low-risk options like real estate or fine art.

- Liquidity Needs: Factor in how quickly you need to access funds, as some alternative assets can be illiquid.

Now, let’s explore the regulations and tax implications that come with these investments.

Regulation and Tax Implications of Alternative Investments

The regulation of alternative investments in India is evolving as the demand for these assets increases among High-Net-Worth Individuals (HNWIs).

As of 2024, India saw a significant wealth boom, adding over 33,000 new millionaires, with the number of HNWIs rising by 5.6% to 378,810.

This surge in wealth is driving interest in alternative investments such as private equity, hedge funds, and real estate, prompting the need for clear regulatory frameworks.

Tax Implications of Alternative Investments in India:

- Private Equity: Capital gains on private equity investments are subject to long-term or short-term capital gains tax, depending on the holding period.

- Real Estate: Property sales are taxed based on capital gains, with higher taxes on short-term profits.

- Cryptocurrency: Digital assets like Bitcoin are taxed based on capital gains; however, the government is considering additional regulations as the sector continues to grow.

- Commodities: Investments in commodities, such as gold and silver, are subject to capital gains tax and GST for specific transactions.

- Venture Capital: Investments in startups may qualify for certain tax exemptions or incentives under India's Start-up India initiative, depending on the nature of the business and the holding period.

Finally, let’s weigh the pros and cons of alternative investments to help you make an informed decision.

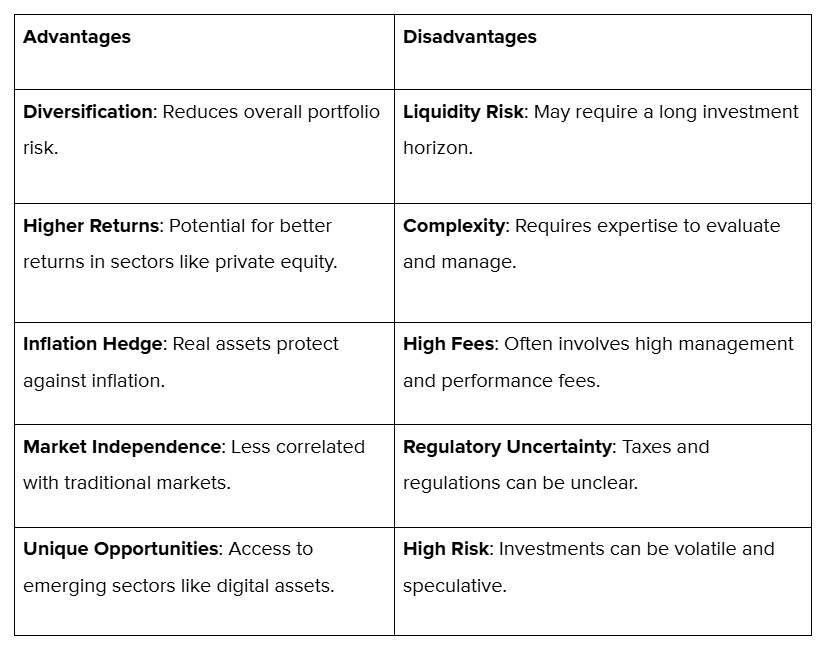

Pros and Cons of Alternative Investments for HNWIs

Alternative investments offer diversification and potentially higher returns, but they also come with increased complexity and associated risks. Here’s a comparison table:

Navigating the world of alternative investments can be complex, which is why the right guidance can make all the difference.

How S45 Guides You on Alternative Investment Decisions

The S45 Club helps SMEs in India grow by providing access to capital, enhancing governance, and facilitating scalable growth strategies.

We provide clear, practical guidance on alternative investments, ensuring they align with your business goals and future plans. Whether your business is in manufacturing, trading, or another sector, we tailor investment strategies to suit your needs.

How we assist with your alternative investment decisions:

- Tailored Strategies: Investment options aligned with your goals and risk tolerance.

- Industry-Specific Advice: Focus on sectors like private equity, real estate, and commodities.

- Liquidity & Risk Consideration: Assess investments based on your liquidity needs and risk appetite..

S45 walks beside you to help explore alternative investments and expand your business with confidence. Connect with S45 today to learn more and get started

Conclusion

Alternative investments can be powerful tools for expanding your business and building lasting wealth. With the right strategy, these assets offer growth potential while aligning with your vision and risk tolerance.

At S45, we walk beside founders to guide such decisions with clarity and purpose. Scaling businesses while preserving legacies is at the heart of what we do. Do you want to plan your investments with purpose and safety? Join Club S45 today, and let’s build lasting value together.

FAQs

1. How can alternative investments be used to preserve wealth across generations?

A: Alternative investments like fine art, real estate, and private equity can act as a wealth-preserving tool for HNWIs looking to pass assets down through generations. These assets often appreciate over time and can provide stability, offering a hedge against inflation and market fluctuations, ensuring wealth retention for future generations.

2. How do HNWIs assess the governance and management of alternative investment funds?

A: For alternative investments, particularly in private equity or hedge funds, governance and management are key factors. HNWIs should ensure that the fund has a strong track record, transparency in operations, and clear exit strategies. Assessing the quality of the fund's management team and their alignment with the investor’s goals is critical.

3. Are there ethical or sustainable alternative investments for HNWIs?

A: Yes, ethical and sustainable investment options like green bonds, renewable energy projects, and impact investing funds are available. These investments allow HNWIs to align their portfolios with their personal values, promoting sustainability and positive societal impact while still aiming for financial returns.

4. How can HNWIs use alternative investments to generate passive income?

A: Certain alternative investments, like real estate or dividend-paying stocks in private equity, offer opportunities for generating passive income streams. These assets offer regular returns, often through rental income or profit-sharing, making them attractive to HNWIs seeking income diversification alongside capital appreciation.

5. How does market sentiment affect alternative investment valuations?

A: Market sentiment can have a significant impact on the valuation of alternative assets, especially those in sectors like art, collectibles, and venture capital. A sudden shift in investor perception or broader market trends can either drive up or decrease the perceived value of these investments, requiring HNWIs to stay agile and well-informed.