Key Takeaways:

- A pitch deck is your first impression, and clarity beats quantity. Investors decide quickly whether to engage.

- Every slide should tell part of a compelling story, moving from problem to solution to opportunity with clear evidence.

- Highlight what sets your startup apart and show momentum through real traction, not hypothetical numbers.

- Design is about guiding attention and making the story easy to follow.

- Tailor your deck to your audience, framing the narrative so investors immediately see why your team and idea matter.

VCs spend an average of just 3 minutes and 44 seconds on a pitch deck. That’s all the time you get to make them care. Every word, every visual, every slide counts—clarity beats clutter, and confidence beats overexplaining.

Notice what just happened?

That stat hooked you, and the follow-up made the lesson concrete. That’s exactly how your pitch deck should work: grab attention fast, tell a clear story, and leave investors wanting more.

In this guide, we break down the principles that turn a good deck into a compelling one.

Why Your Pitch Deck Matters

When you’re an early-stage founder, your pitch deck isn’t just a presentation. It’s your entry ticket to the fundraising conversation.

Before investors meet you, your deck often does the talking. And in a crowded startup environment where hundreds of decks land in inboxes every week, the difference between getting ignored and getting invited to pitch usually comes down to clarity and storytelling.

A strong pitch deck does three things well:

- Captures attention fast. Investors spend less than four minutes on average reviewing a deck. If the problem and opportunity aren’t obvious right away, you risk losing them.

- Builds trust. The right structure and supporting data show that you’ve thought through execution.

- Opens doors. The goal isn’t to raise money immediately; it’s to secure the next meeting where you can dive deeper.

Founders often get caught in the trap of overloading their deck with details, but what investors want is a compelling narrative backed by proof points.

That’s why building the right deck is as much about storytelling as it is about numbers.

The s45club was created to support founders on this journey, connecting them with mentors, investors, and a community that helps refine both the pitch and the growth strategy behind it.

Core Elements of a Winning Startup Pitch Deck

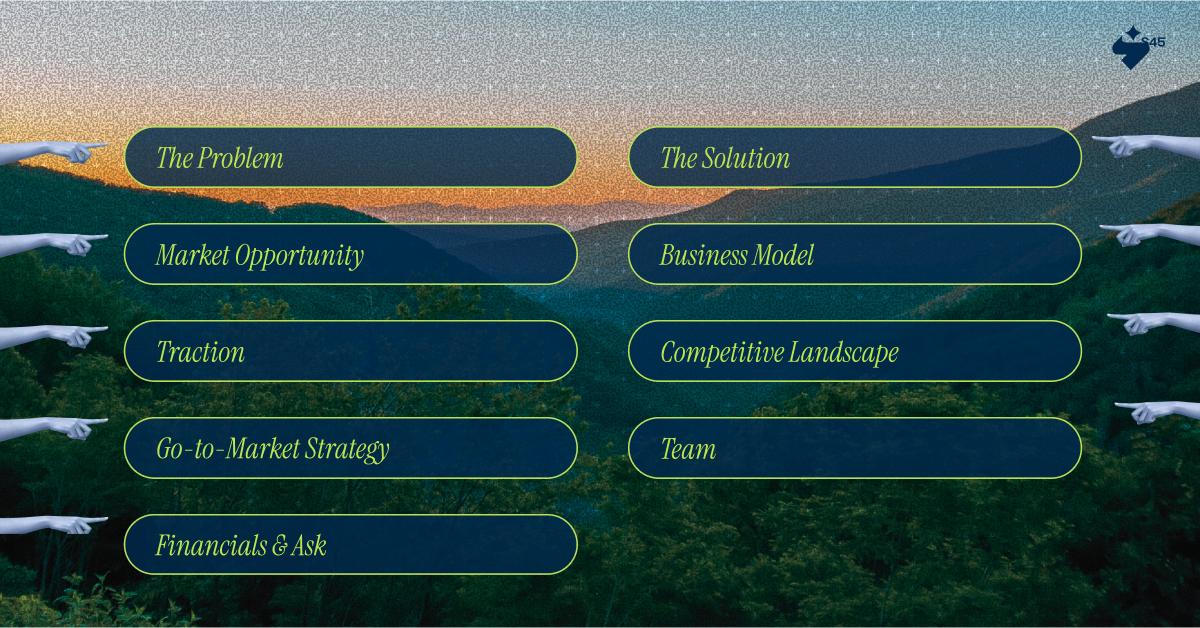

Alt text: Core Elements of a Winning Startup Pitch DeckA great pitch deck isn’t about fancy design or cramming in every detail. The best decks are short, sharp, and geared toward one goal: securing the next conversation. From sitting in investor rooms and watching decks succeed (and fail), here’s what matters most slide by slide.

1. The Problem: Why does this matter right now?

If your audience doesn’t feel the pain, they won’t lean in for the solution. Bring the problem to life with a stat that stings or a customer story that hits home. The best decks make investors nod and think, “I know this pain exists.”Pro tip: Avoid generic lines like “X industry is broken.” Get specific — investors see that line every week.

2. The Solution: How exactly are you fixing it?

This is where founders often lose the room. Keep it simple and visual. A clean mockup or a single screenshot says more than a wall of text. Investors want to see how your solution works in practice, not just hear the theory.

Pro tip: Don’t oversell. Show how your product solves the problem in one or two clear steps.

3. Market Opportunity: Is this big enough to care about?

Every deck has a TAM, SAM, and SOM slide, but what separates good from bad is credibility. Overblown numbers kill trust instantly.

Pro tip: Show investors you know where to start. Instead of just “₹1,680 crore global market,” highlight your wedge: “We’re targeting a ₹50 crore niche within this market, growing 18% YoY.” That shows focus and realism.

4. Business Model: How do you actually make money?

Clarity wins. If you can’t explain to someone else in one sentence how you make money, you’ve already lost them.

Pro tip: Use real examples if you have them: “Early customers are paying ₹1,500 per month” is far stronger than “We plan to charge subscriptions.”

5. Traction: What proof do you have that it works?

Nothing builds credibility like proof. It doesn’t have to be massive revenue — pilots, waitlists, letters of intent, or even engagement growth can show traction.

Pro tip: Frame traction as momentum. A single number is static, but showing growth over time makes the story compelling.

6. Competitive Landscape: Why you, not the others?

Every investor has this question: “Why you, and not the other ten startups I’ve seen in this space?” Don’t dodge competition by saying “we have none.” Even inertia and Excel count as competitors.

Pro tip: A simple 2x2 chart or matrix works, but the real goal is to show your unique angle — the unfair advantage others can’t replicate.

7. Go-to-Market Strategy: How will you get customers at scale?

It’s not enough to say “we’ll use digital ads.” Investors want to know why this channel and why now.

Pro tip: Share how you’ve already tested acquisition. “We ran a ₹50,000 LinkedIn campaign and acquired 50 sign-ups at ₹1,000 each” lands much better than vague plans.

8. Team: Why is your team the one to win?

Investors often back people more than ideas. Show why your team can execute. Prior startup exits, deep domain expertise, or unique industry connections carry weight.

Pro tip: If you don’t have “big names,” highlight the team’s unfair advantage. For example, insider knowledge of an industry or access to distribution channels.

9. Financials & Ask: What do you need, and what will it achieve?

Keep this clean. No 10-year forecasts with hockey-stick growth curves. Show a 2–3 year roadmap and tie your raise directly to milestones.

Pro tip: Be explicit: “We’re raising ₹3 crore to scale sales and expand engineering. This gives us 12 months of runway to hit ₹6 crore ARR.” Investors want to see how funds translate into milestones.

The s45club helps founders polish these nine elements into an investor-ready narrative. With peer feedback and expert guidance, you’ll know what to put on each slide and also how to frame it the way investors actually think.

Designing a Pitch Deck That Wins Investor Attention

Alt text: Designing a Pitch Deck That Wins Investor AttentionMost founders think design means “making slides pretty.” In reality, design is about control: controlling where the investor’s eye goes, what sticks, and what gets skipped. A well-designed deck guides the room through your story with zero friction. Done right, investors don’t even notice the design; they just get the message.

Here are a few principles that separate an effective deck from one that gets ignored. Let’s look at them one by one.

1. Keep It Visually Clean and Simple

Investors should be able to grasp each slide in under 10 seconds. That means one key idea per slide, clean fonts, and a consistent look.

Example: Airbnb’s original pitch deck had just 10 slides. The “Problem” slide was three short bullet points, no clutter, no long paragraphs. That simplicity let the investor’s brain focus on the idea, not fight through formatting.

Alt text: Airbnb’s original pitch deck

What you can do:

If you find yourself reducing the font size to make things fit, it is a sign that you are trying to say too much.

2. Turn Facts Into a Narrative

The best decks tell a story. Investors want to feel pulled through a narrative arc: problem → solution → market → traction → vision.

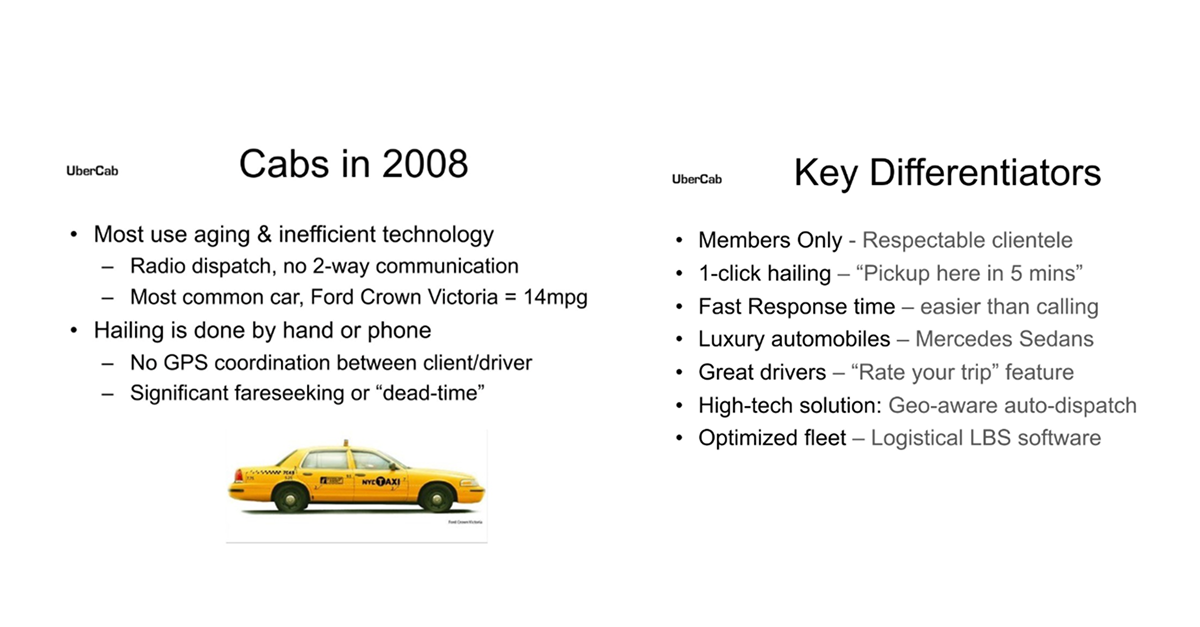

Example: Uber didn’t just list features. Their deck created contrast: the hassle of flagging a cab versus the elegance of pushing a button. It was a story every investor could relate to from their own lives.

What you can do:

Your first three slides should set the hook: the problem, your solution, and why it matters today. Nail that sequence, and the rest flows naturally.

3. Highlight What Sets You Apart

Most founders underestimate how similar their deck looks to competitors. Your advantage needs to be more than “better design” or “faster service.” It should feel like something others can’t easily copy.

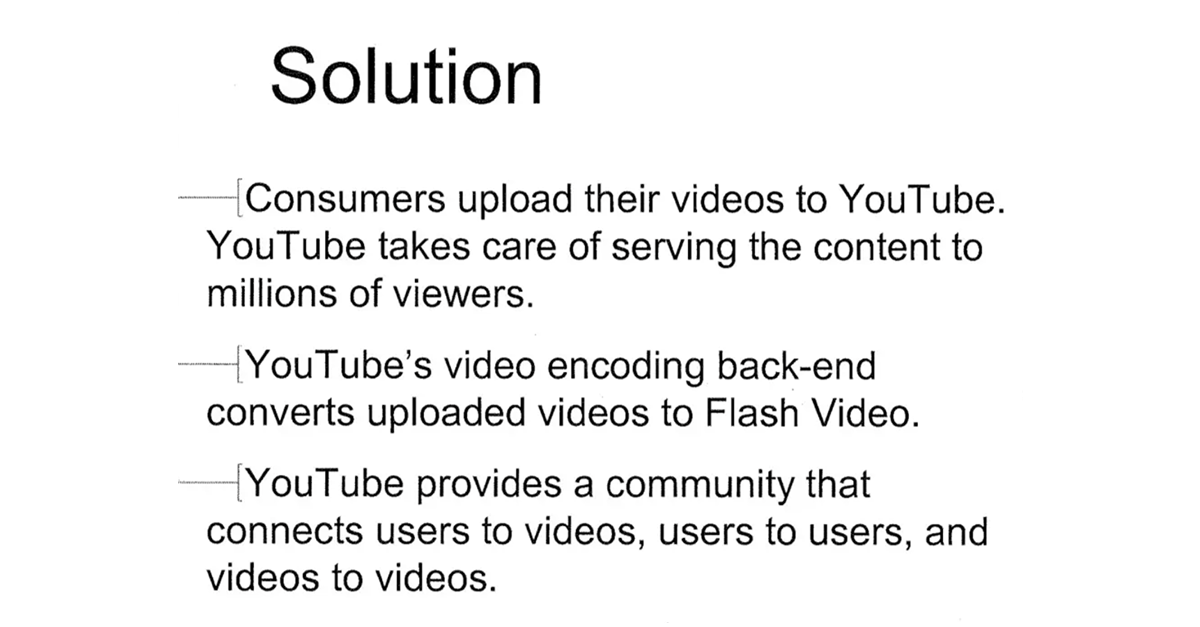

Example: YouTube’s pitch to Sequoia focused on its unique edge: easy video uploading and instant sharing. At a time when online video was technically difficult, this usability gap became their unfair advantage. It was not just another video platform; it was the first one built for speed, simplicity, and viral spread.

What you can do:

Ask yourself, “What would make an investor say, ‘This team sees something others missed’?” That’s your unfair advantage slide.

4. Use Data as Evidence

Investors see countless projections with hockey-stick growth. What gets their attention is evidence of momentum: real numbers, engagement, or customer behavior.

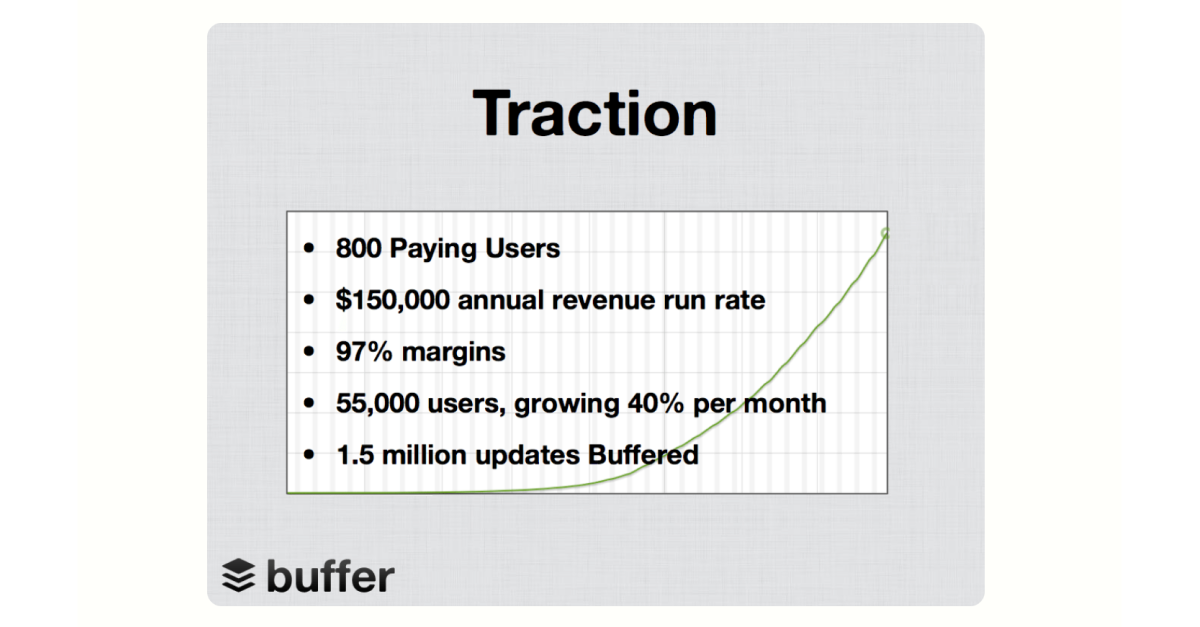

Example: Buffer’s traction slide showed real ARR growth with a clean line chart. It was powerful because it was actual data, not assumptions.

What you can do:

Replace “We will have 1M users in 2 years” with “We grew from 1,000 to 10,000 users in 6 months.” Investors back momentum, not hypotheticals.

5. Read the Room, Shape the Deck

Not all investors think alike. Angels may care more about founder passion and vision. VCs often drill into market size and scalability. Accelerators want to see early traction and growth potential.

Example: Dropbox’s original seed pitch deck is often cited as a model for clarity. It focused tightly on the problem, the solution, and the market opportunity without overloading investors with detail. The simple storytelling and clean slides made the value proposition obvious at a glance, which helped them raise their early funding.

What you can do:

Have a “core” deck, but adjust emphasis depending on who you’re talking to. Investors can tell when they’re looking at a generic copy-paste pitch.

Turning Your Deck Into an Investor Magnet

A pitch deck is your story, your proof, and often your first impression with investors. The best decks make the problem obvious, the solution compelling, and the opportunity believable. They show traction without exaggeration and team strength without fluff.

But building that kind of deck is hard to do in isolation. Founders often struggle with knowing what to cut, how to frame the story, or how to balance design with substance.

That is where the s45club steps in.

As a founder-first community, s45 connects you with mentors, investors, and peers who have navigated the same journey. Our hypergrowth playbook helps you refine your deck as well as your entire approach to fundraising — from sharpening your story to scaling with governance and long-term sustainability in mind.

The right pitch deck will raise money on its own, get you into the right rooms, and give you the chance to tell your story. With s45 as your partner, you are preparing for scale with clarity and confidence.

Join the s45club today and take the next step on your hypergrowth journey.

FAQs

Q: How long should my pitch deck be?

A: Keep it short and sharp. 10–12 slides are ideal. Focus on telling a clear story, not including every detail.

Q: Do I need fancy design skills to make a good deck?

A: No. Design is about guiding attention and making your story easy to follow. Clean, simple slides work better than flashy ones.

Q: Should I include detailed financial projections?

A: Only enough to show milestones and how funds will be used. Avoid long-term forecasts or unrealistic growth projections.

Q: How much should I tailor my deck for different investors?

A: Tailor the emphasis. Angels may focus on founder passion, while VCs drill into market size and scalability. Keep the core story consistent.

Q: What is the most common mistake founders make in a deck?

A: Overloading slides with text, generic statements, or unrealistic numbers. Investors want clarity, credibility, and a compelling narrative.

Q: How can I show traction without revenue?

A: Highlight real momentum such as user growth, pilot programs, letters of intent, or engagement metrics. Proof of progress matters more than absolute numbers.