Key Takeaways

- CCD Structure: Combines debt and equity features, with fixed interest payments and mandatory conversion into equity shares.

- Valuation Approach: Separates liability and equity components, using discounted cash flows and treating residual value as equity.

- Regulatory Compliance: Requires valuation reports for predetermined conversion pricing; deferred valuation permitted if linked to future financing rounds.

- Common Valuation Methods: Includes discounted cash flow (DCF), market comparables, and cost approaches.

- Importance of Accurate Valuation: Protects investor interests, ensures legal compliance, and helps startups with structured fundraising.

Confused by complex startup funding options?

Compulsory Convertible Debentures (CCDs) offer fixed returns and equity potential if you know how to value them correctly.

These instruments offer investors fixed returns initially, before mandatorily converting into equity shares after a specified period or event, balancing risk and ownership dilution.

Yet, the complex nature of CCDs means valuation is not straightforward. Regulatory mandates from SEBI and RBI, compliance with the Companies Act, and tax considerations require precise and timely valuation to ensure legal conformity and financial clarity.

This blog explains what CCDs are, why their valuation matters in today’s regulatory industry, the key valuation methods used, and how companies and investors can manage common challenges for successful funding and compliance.

Why CCD Valuation Matters: Accuracy, Compliance, and Strategic Insights

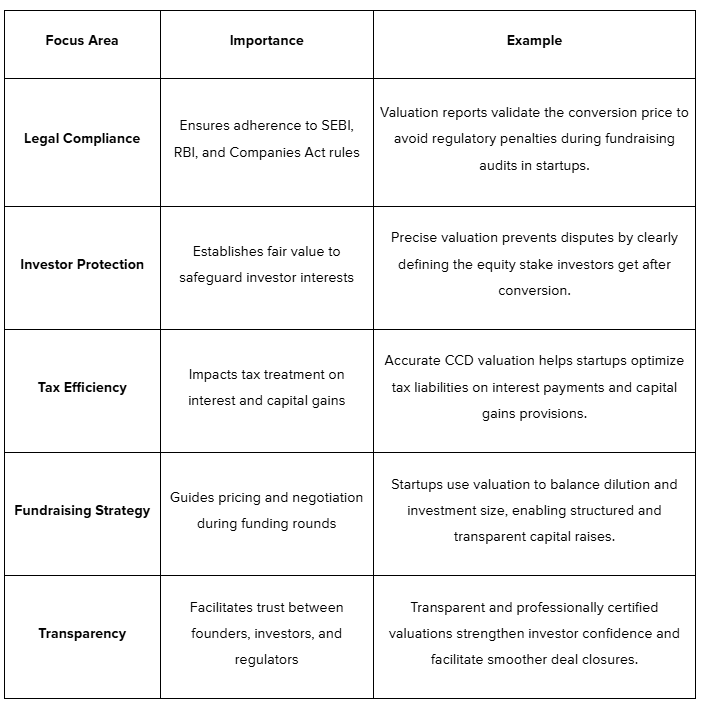

CCD valuation ensures accurate pricing, legal compliance, investor protection, and an effective fundraising strategy. Let’s explore these key areas:

The table helps you understand the key CCD valuation methods, ensuring accurate pricing and compliance. Platforms like S45 partners with entrepreneurs looking to grow from local leaders to global players. The founder-first approach combines strategic insights, network access, and operational expertise to drive sustainable growth through Compulsory Convertible Debentures (CCDs).

Since CCDs straddle the line between fixed-income instruments and equity, their valuation cannot follow a single, straightforward approach.

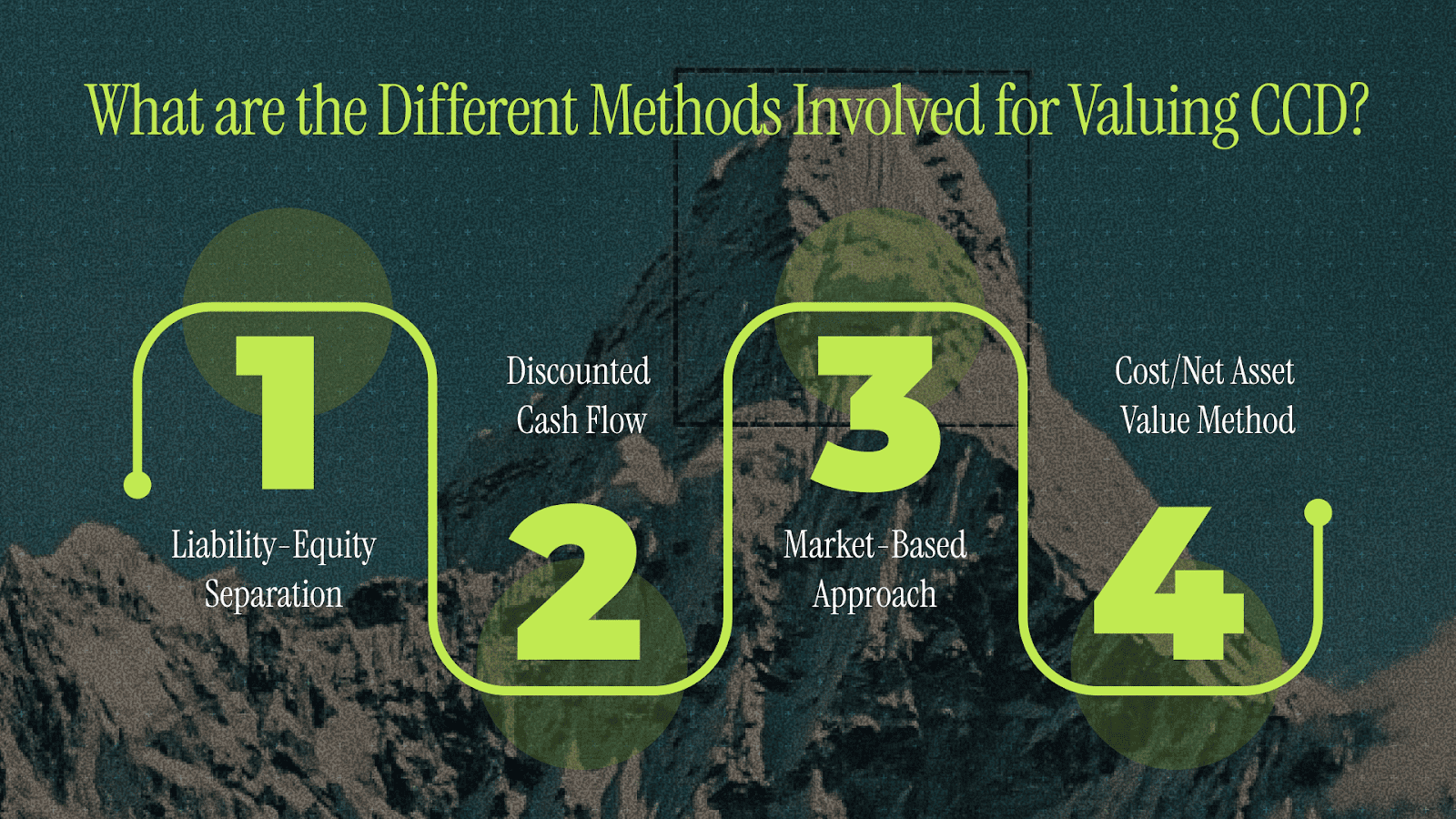

What are the Different Methods Involved for Valuing CCD?

Valuing Compulsory Convertible Debentures (CCDs) requires addressing their dual nature as both debt and equity instruments. The main valuation methods are:

1. Liability-Equity Separation

The liability part is valued by discounting future fixed coupon and principal repayments at an effective market interest rate, which is typically higher than the coupon rate. The equity component is measured as the residual value after subtracting the liability component from the total instrument value. This approach aligns with Indian accounting standards Ind AS 32 and 109, consistent with IFRS guidance.

2. Discounted Cash Flow (DCF) Method

This method projects the future cash flows of the CCD, including interest payments and repayment at maturity or conversion, and discounts them back to present value using a risk-adjusted rate. Sensitivity analyses address uncertainties in discount rates and payment timing.

3. Market-Based Approach

When market data is available, valuation uses prices and multiples derived from comparable securities or recent funding rounds. Adjustments are made for company-specific risks, size, and liquidity differences.

4. Cost/Net Asset Value Method

Suitable for early-stage companies without reliable market comparables, this method values CCDs based on the company’s net assets or replacement cost of assets, as a proxy for value.

Additionally, advanced valuation techniques like lattice and option-pricing models may be applied in complex CCD structures involving call/put options, dividend yields, or early conversion features to capture embedded optionality.

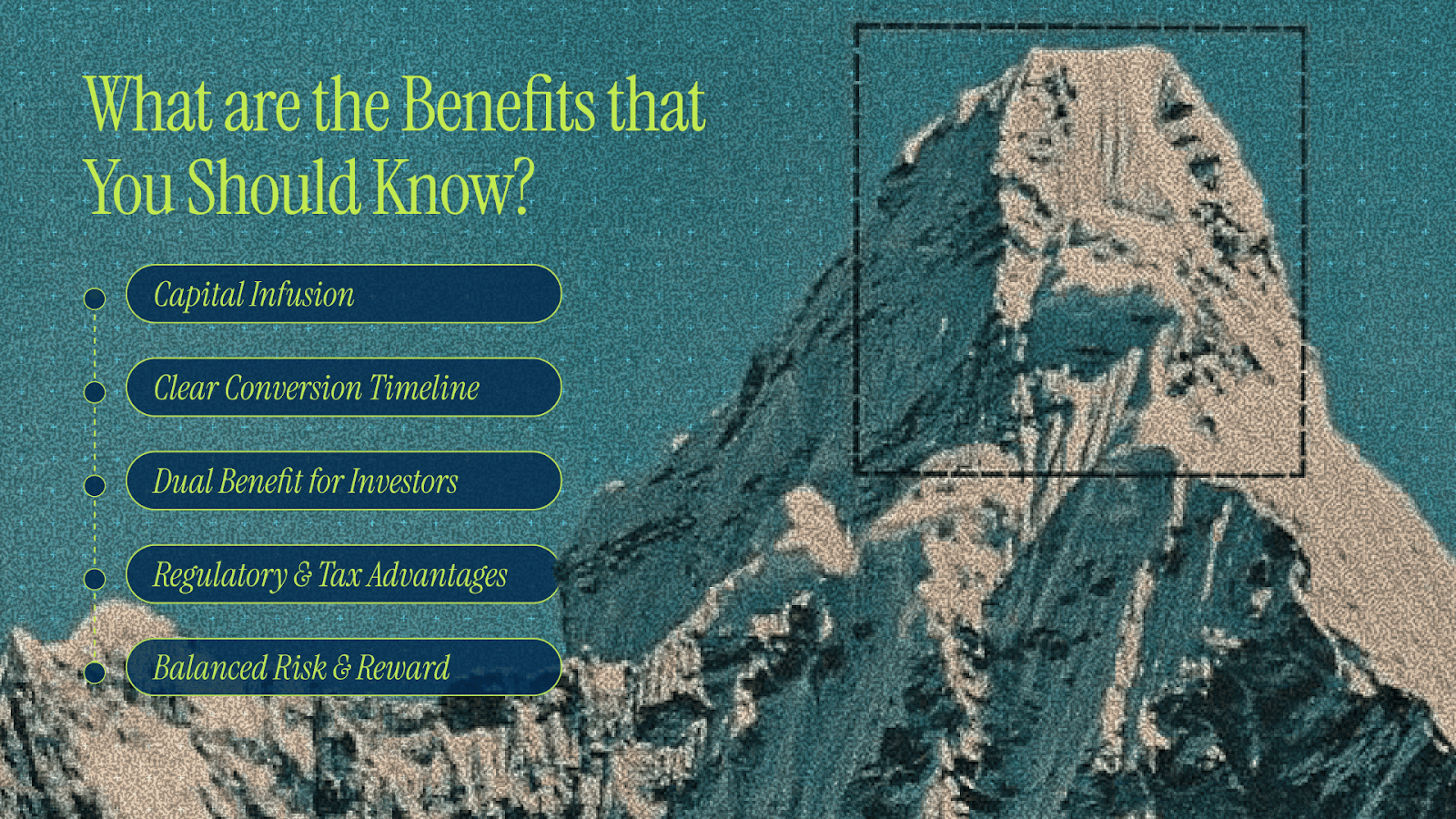

What are the Benefits that You Should Know?

Compulsory Convertible Debentures (CCDs) offer several advantages for both companies and investors:

- Capital Infusion without Immediate Dilution: Companies can raise funds without diluting ownership or control right away, helping maintain operational autonomy during critical growth phases.

- Clear Conversion Timeline: The pre-set conversion schedule aids in financial planning and forecasting for businesses and investors, easing resource allocation and strategic decisions.

- Dual Benefit for Investors: Investors enjoy fixed interest payments initially, providing steady income, while also gaining equity ownership and potential upside when CCDs convert.

- Regulatory and Tax Advantages: CCDs help optimize tax liabilities, with interest paid sometimes deductible for the issuer, and conversion structured to avoid immediate tax events for investors.

- Balanced Risk and Reward: Investors receive downside protection from fixed returns and the opportunity for equity participation, making CCDs an attractive hybrid investment.

For example, a tech startup issued CCDs that provided investors with 8% annual interest and an equity stake upon conversion, aligning investor returns with company growth without immediate dilution for founders. Here’s how you can do it.

Scale Your Business with S45’s Expert Support and CCD Solutions

At S45, we understand that MSME founders and entrepreneurs need more than just capital to scale successfully. Our unique approach combines both funding and strategic expertise, helping you grow your business sustainably while preserving your legacy.

For businesses ready to leverage hybrid financing like Compulsory Convertible Debentures (CCDs), S45 provides tailored solutions to balance immediate funding needs with long-term equity growth. Here’s how we help:

- Capital and Expertise: We guide you through the CCD valuation process, ensuring accurate pricing and regulatory compliance while providing strategic advice for optimal funding solutions.

- Sustainable Growth Focus: S45 helps you scale purposefully, with clear conversion terms in CCDs that allow for both capital infusion and eventual equity participation, ensuring steady growth without sacrificing control.

- Innovation and Legacy: By using CCDs, you can secure funding for innovation and expansion, while maintaining the core values and vision that have driven your success, ensuring your business legacy endures.

- Strategic Investor Partnerships: We ensure your CCD structure fosters trust and long-term partnerships with investors, facilitating future funding rounds while aligning with your company’s goals.

With S45, you're not just accessing capital, you're building a lasting business with sustainable growth strategies and a clear path to scale. Let us help you secure your future with strategic CCD financing and expert guidance.

Conclusion

The right capital and advisory support are critical for MSMEs to scale sustainably and build lasting legacies. Instruments like Compulsory Convertible Debentures allow founders to access growth capital without sacrificing control prematurely. But funding alone isn’t the full story; governance, clear valuation, and readiness to engage investors play an equally pivotal role.

S45 Club combines capital access with expert equity advisory tailored to India’s MSMEs, helping founders navigate these challenges with confidence and clarity.

Looking to connect with peers who’ve successfully scaled their businesses with strategic funding? Join the S45 Club community to share insights, explore collaboration opportunities, and grow alongside India’s most ambitious founders.

FAQs

Q. What is CCD in valuation?

A. A CCD is valued as a hybrid of debt and equity. The debt portion is measured by discounting expected coupon payments and principal at an appropriate market rate. The equity value is then calculated as the residual, representing the ownership potential after debt obligations are subtracted. This dual approach ensures compliance with accounting standards like Ind AS 32/109 and IFRS, providing a transparent valuation method.

Q. How to calculate the fair value of CCD?

A. The fair value of CCDs is determined by splitting them into debt and equity components. The debt side involves discounting future cash flows (interest and principal) using a market yield higher than the coupon rate. The equity value equals the difference between the total issue price and debt value. In complex cases, option pricing models such as Black-Scholes may also be applied to reflect conversion features.

Q. Can CCD be converted after 10 years?

A. Generally, CCDs are designed with a maximum conversion timeline of 10 years, in line with regulatory and contractual practices. If a company wishes to extend beyond this period, specific approvals or customized contractual terms must be included. Otherwise, conversion into equity must occur within the defined tenure. This ensures regulatory compliance while safeguarding investor rights to equity participation within a fixed timeframe.

Q. What is a CCD in finance?

A. A Compulsory Convertible Debenture (CCD) is a financial instrument that starts as debt, offering fixed interest payments, but must mandatorily convert into equity shares after a set period. This provides investors with both short-term income security and long-term ownership in the company. For businesses, CCDs are an attractive financing route as they delay equity dilution while securing much-needed capital for growth and expansion.

Q. What are the benefits of CCDs?

A. CCDs offer a blend of stability and growth potential. Companies benefit by raising capital without immediate dilution of equity and by aligning investor interest with future growth. Investors gain steady coupon payments initially, with the upside of equity ownership upon conversion. This hybrid structure balances risk and reward, making CCDs attractive for entrepreneurs seeking funds and for investors looking for income plus long-term equity exposure.