Key Takeaways

- India's startup ecosystem is rapidly growing, with 12-15% annual growth.

- Government schemes like SISFS, SAMRIDH, and CGTMSE provide funding and resources for startups at various stages.

- Schemes offer collateral-free loans, grants for product development, and market access.

- S45 improves these opportunities with mentorship, market expansion, and sustainable growth strategies.

- Find the right funding and resources to scale your business successfully.

India now has the 3rd largest startup ecosystem globally, with a steady growth rate of 12-15% annually. As a founder, securing the right funding can often feel like a major hurdle, but it's a critical step in scaling your business.

Long-term success isn't just about securing capital; it's about accessing the right resources that align with your vision and growth strategy. Organizations like S45 are focused on supporting founders, offering the strategic guidance and resources necessary for sustainable scaling.

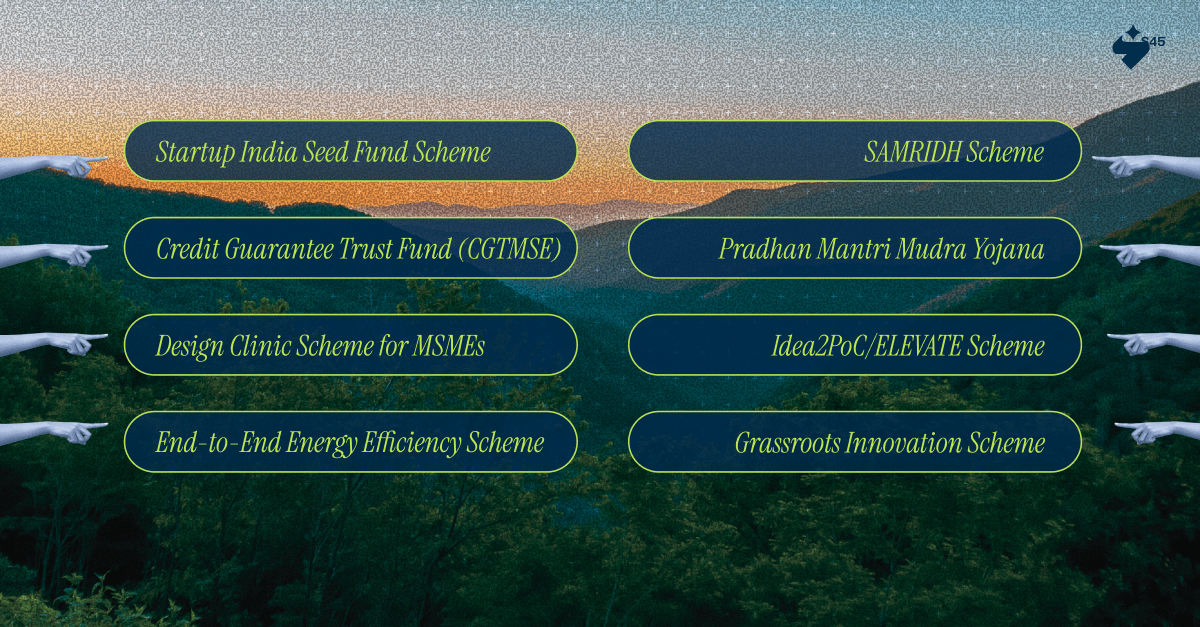

1. Startup India Seed Fund Scheme (SISFS)

The Startup India Seed Fund Scheme (SISFS) is designed to provide financial support to early-stage startups working on innovative tech-based products. The scheme aims to help startups with prototype development, product testing, and market entry.

Eligibility Criteria That You Must Know:

- DPIIT-recognized startups.

- Focus on technology-driven solutions.

- Indian promoters must hold at least 51% equity.

Benefits That Help You:

- Grant Size of up to ₹20 lakh for prototype development.

- Access to incubators and entrepreneurial networks.

- Support for productization and scaling.

Application Link: Visit here for detailed application guidelines and to apply.

2. SAMRIDH Scheme

The SAMRIDH Scheme targets product-based startups that have a proven product-market fit and are ready to scale. This funding provides startups with financial assistance, mentorship, and access to global markets.

Eligibility:

- Indian startups with viable business plans.

- Preference for startups with prior accelerator program experience.

Benefits:

- Grant Size of up to ₹40 lakh in funding.

- Up to ₹40 lakh in funding.

- Access to mentorship, market access, and support for global scaling.

Application Link: Visit here for detailed application guidelines and to apply.

3. Credit Guarantee Trust Fund for Micro & Small Enterprises (CGTMSE)

The CGTMSE scheme aims to provide collateral-free loans to MSMEs, particularly benefiting startups that lack the assets required for traditional loans. It helps businesses access capital quickly, with a focus on reducing the risk for lenders and improving credit access for borrowers.

Eligibility:

- MSMEs in the manufacturing and services sectors.

- Focus on women entrepreneurs is encouraged.

Benefits:

- Grant Size of up to ₹1 crore in collateral-free loans.

- Reduced lender risk and wider credit access.

- Includes both term loans for capital investments and working capital loans to support day-to-day operations.

Application Link: Visit here for detailed application guidelines and to apply.

4. Pradhan Mantri Mudra Yojana (PMMY)

The PMMY scheme provides financial assistance to small businesses across various sectors. It helps startups access loans without the burden of collateral, with a focus on simplifying the application process and lowering the cost of capital.

Eligibility:

- Non-corporate, non-farm small businesses.

- Startups in manufacturing, services, and trade sectors.

Benefits:

- Grant Size of up to ₹10 lakh, depending on business size.

- Three loan categories: Shishu (up to ₹50,000), Kishor (up to ₹5 lakh), and Tarun (₹5 lakh - ₹10 lakh).

- No collateral required.

Application Link: Visit here for detailed application guidelines and to apply.

5. Design Clinic Scheme for MSMEs

The Design Clinic Scheme is targeted at MSMEs that have not yet utilized design in their product development. The scheme provides financial assistance to integrate design thinking, improving product aesthetics and functionality to increase market competitiveness.

It includes two funding streams: Design Awareness (seminars and workshops) and Design Project Funding.

Eligibility:

- MSMEs without prior design experience.

- Must collaborate with approved design entities.

Benefits:

- Grant Size of up to 60% of design project expenses, with a cap of ₹15 lakh for groups of four or more MSMEs, ₹9 lakh for groups of three or fewer, and ₹2 lakh for projects by final-year students.

- Financial assistance for design projects.

- Expert guidance for integrating design into product development.

Application Link: Visit here for detailed application guidelines and to apply.

6. Idea2PoC/ELEVATE Scheme (Karnataka)

The Idea2PoC/ELEVATE Scheme supports innovative startups based in Karnataka by providing grants and incubation support. This initiative helps young startups refine their product ideas, gain access to mentorship, and scale operations.

Eligibility:

- The startup should be registered in Karnataka.

- Young startups under 10 years old.

- Annual revenue under ₹100 crore.

- Eligibility requirements vary across different tracks, such as Elevate Kalyana Karnataka for startups from certain districts, AMRITA for entrepreneurs from Other Backward Classes, and Elevate Unnati for entrepreneurs from Scheduled Castes/Scheduled Tribes.

Benefits:

- Grant Size of up to ₹50 lakh in grants.

- Mentorship, incubation, and access to entrepreneurial networks.

Note:

The application process involves a rigorous evaluation conducted in multiple stages. A jury of industry experts and government representatives assesses each proposal based on the idea, team, and market potential.

Application Link: Visit here for detailed application guidelines and to apply.

7. 4E (End-to-End Energy Efficiency Scheme)

The 4E Scheme focuses on improving energy efficiency in MSMEs, helping businesses reduce costs and increase sustainability in operations. The scheme provides financial support to help implement energy-saving practices across production processes.

Eligibility:

- MSMEs with a cash profit track record.

- Focus on businesses that want to improve energy efficiency.

Benefits:

- Grant size is based on energy savings and business needs.

- Support for reducing energy consumption and costs.

- Focus on improving operational sustainability.

Application Link: For detailed application procedures and guidelines, consult SIDBI.

8. National Innovation Foundation (NIF) – Grassroots Innovation Scheme

The NIF Grassroots Innovation Scheme supports innovators from rural and semi-urban India, providing grants to develop innovative solutions for local challenges. The scheme aims to encourage solutions that have a social impact and can benefit grassroots communities.

Eligibility:

- Innovators from rural and semi-urban India.

- Focus on grassroots-level innovations.

Benefits:

1. Grant Size:

- Grants for prototype development (₹1-5 lakh).

- Intellectual property protection grants (₹50,000 - ₹2 lakh).

- Funding for commercialization (up to ₹10 lakh).

- R&D grants (₹10-15 lakh).

2. Encouragement of socially impactful innovations.

Application Link: Visit here for detailed application guidelines and to apply.

These funding schemes provide crucial support to help your startup grow. However, finding the right guidance and strategic partnerships can further improve your progress.

How Can S45 Help You Scale Your Startup?

S45 is a strategic growth partner that empowers startups to scale sustainably. By combining financial support with expert advice, S45 helps founders build businesses with a focus on long-term success. Their approach blends innovation with legacy, ensuring your growth is both purposeful and sustainable.

What S45 Can Provide:

- Capital and Expertise: Access to funding and expert guidance personalized to your business needs.

- Sustainable Growth Focus: Support in scaling your business steadily, with a focus on lasting success.

- Innovation and Legacy: Helping you bridge innovative strategies with time-tested business practices for future growth.

Get in touch today to discover how S45 can support your startup's journey to success.