At a glance

- Investor types will help you explore angel networks, VC firms, online platforms, government programs, and corporate VCs for different funding opportunities.

- Build relationships early to start networking 6-12 months before you need funding to establish trust and visibility.

- Craft a perfect pitch to focus on a clear problem-solution statement, market opportunity, traction proof, and team strength in under 2 minutes.

- Match investor to stage to choose investors based on your current business stage (early validation, proven traction, strategic partnerships).

- Avoid red flags by watching out for investors who push for aggressive timelines or excessive control, or who lack an understanding of your business model.

Did you know? In 2025, 58.1% of founders listed raising capital as their primary challenge. Finding investors for your startup isn’t just about getting the funds you need; it’s about building meaningful, long-term relationships that help bring your business vision to life.

As an MSME founder in India, you're likely focused on scaling your operations, innovating in your industry, and building a legacy that lasts. However, securing the right funding to fuel these ambitions is often easier said than done.

In this blog, we will guide you through the critical steps to finding the right investors and securing the financial backing your startup needs.

Why Finding Investors is Important For Your Startup Business?

When you bring investors on board, you’re gaining partners in your journey. Their experience and guidance can make all the difference in whether your business takes off or faces hurdles.

Here are five reasons why investors are important for your startups:

- Capital for Growth: Investors provide the financial runway to expand manufacturing, hire talent, and enter new markets. Without adequate funding, even great ideas struggle to scale.

- Strategic Expertise: Experienced investors have walked similar paths. They help you avoid costly mistakes while identifying opportunities you might miss.

- Network Access: Quality investors open doors to key customers, strategic partnerships, and top talent that would take years to build independently.

- Market Credibility: Having respected investors validates your business model and provides social proof that accelerates customer acquisition.

- Risk Mitigation: Different investors bring different perspectives, operations, technology, and market expansion. This collective wisdom strengthens your business foundation.

For MSME founders, the right investors bridge traditional business practices with modern growth strategies, helping you evolve without losing your core identity.

Wondering where to find investors and how to secure them? Read on to find out.

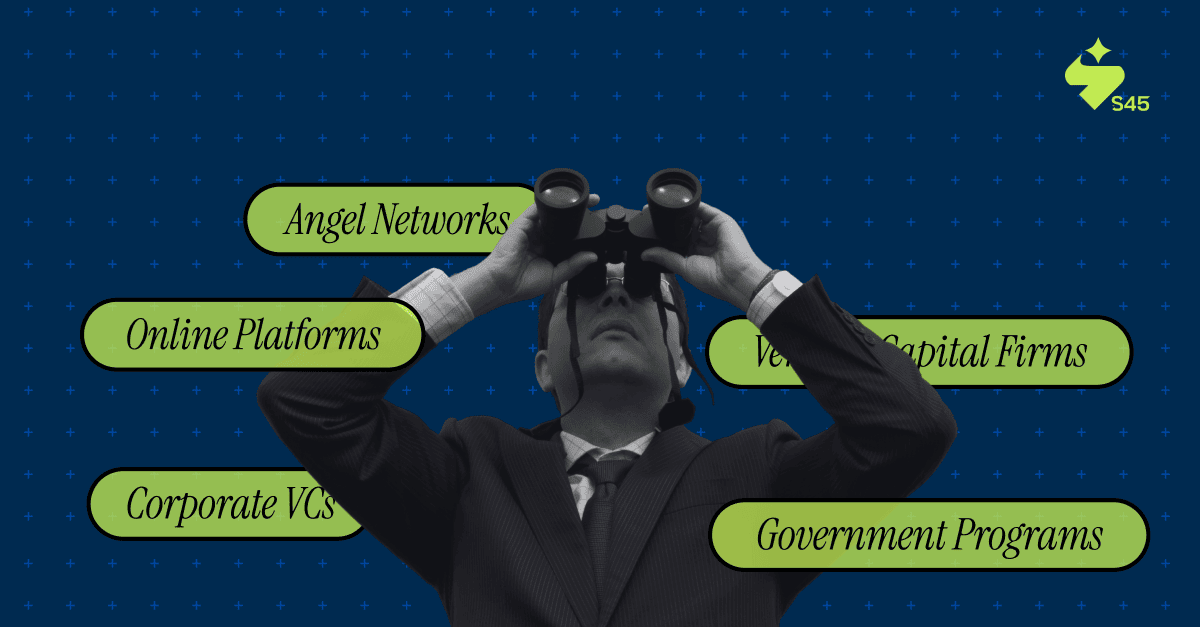

Ways to Find and Secure Investors for Startups

The Indian startup ecosystem has plenty of ways to connect with potential investors, each offering its own set of opportunities. Here are some platforms where you can find investors:

1. Angel Networks

Angel investors are individual high-net-worth investors who provide more than just money. They offer mentorship, industry connections, and hands-on guidance based on their entrepreneurial experience.

Best for: Early-stage startups (Investment amount range: $25k-$500k)

- Indian Angel Network (IAN)

- Mumbai Angels

- Chennai Angels

How to secure: Build relationships at networking events. Angels invest in people, so demonstrate passion and coachability alongside your business metrics.

2. Venture Capital (VC) Firms

These are professional investment firms managing institutional money with structured evaluation processes and portfolio support systems. They bring substantial capital and extensive networks but have specific return expectations.

Best for: Proven traction (Investment amount range: $1M-$50M+)

- Sequoia Capital India

- Accel Partners

- Matrix Partners India

How to secure: Research their portfolio and investment thesis. Get warm introductions through mutual connections. Tailor your pitch to their focus areas.

3. Online Investment Platforms

These are digital marketplaces that democratize access to investors by allowing startups to showcase their businesses to a broader investor community through structured profiles and pitch presentations.

Best for: Digital networking and exposure

- LetsVenture

- AngelList India

- Ah! Ventures

How to secure: Create compelling profiles with regular updates. Treat these as relationship-building tools, not just pitch platforms.

4. Government Programs

This consists of public sector initiatives designed to support entrepreneurship and innovation, typically offering favorable terms and non-dilutive funding to businesses aligned with national priorities.

Best for: Non-dilutive funding

- Startup India initiatives

- SIDBI funding programs

- State government schemes

How to secure: Align your business with government priorities. Expect longer application processes but favorable terms.

5. Corporate VCs

These are investment arms of large corporations seeking strategic partnerships with startups that complement their core business operations or provide access to new technologies and markets.

Best for: Strategic partnerships

- Tata Capital

- Mahindra Partners

- Reliance Ventures

How to secure: Show how your startup adds value to their core business. Leverage existing corporate relationships where possible.

However, to position yourself for fundraising success, a strategic approach is always good for finding investors.

Strategic Approach to Find Investors for Your Startup Business

A strategic approach towards finding investors maximizes visibility, credibility, and investor interest in your business. The most successful founders treat investor outreach as a carefully orchestrated campaign that builds momentum over time.

- Start Early: Begin networking 6-12 months before you need funding. The best investor relationships develop over time, not during desperate fundraising periods.

- Use Warm Introductions: Leverage mentors, advisors, and other entrepreneurs for investor introductions. A trusted referral carries 10x more weight than cold emails.

- Show Consistent Progress: Update your network monthly with key milestones, customer wins, and team additions. Momentum attracts investors more than potential alone.

- Be Selective: Target 15-20 well-researched investors rather than mass emailing 200. Quality outreach yields better results than spray-and-pray approaches.

- Perfect Your 2-Minute Pitch: Practice until you can clearly explain your value proposition, market opportunity, and growth strategy in under two minutes. Opportunities arise unexpectedly.

- Prepare Documentation: Organize financial records, legal documents, and business metrics before you start outreach. Prepared founders inspire confidence.

At S45, we understand that MSME founders need more than just capital. We provide both funding and expertise, walking beside you as partners in sustainable growth rather than just investors writing checks.

How to Write a Perfect Startup Pitch?

Your pitch is a story that connects your vision with an investor's desire to be part of something meaningful. The most compelling pitches don't just present facts; they create emotional resonance while demonstrating clear business logic.

Problem + Solution (30 seconds): Start with a relatable problem your target customers face daily. Then present your unique solution and why existing alternatives fall short.

Market Opportunity (30 seconds): Quantify your Total Addressable Market with credible data. Explain why now is the right time and why you're positioned to capture meaningful market share.

Traction Proof (45 seconds): Show metrics that prove market validation: revenue growth, customer retention, and user adoption. Include specific numbers and customer testimonials.

Team Strength (15 seconds): Highlight why your specific team can execute this vision. Focus on relevant experience and complementary skills.

Financial Ask (20 seconds): State exactly how much you need, what you'll use it for, and what milestones you'll achieve. Create urgency about why investors should act now.

Practice Structure:

- Write a 10-slide deck maximum

- Practice the 2-minute verbal version

- Prepare for 10 minutes of Q&A

- Have detailed backup slides ready

Remember, your investors hear dozens of pitches weekly. Make yours memorable through clear storytelling and concrete proof points.

But how would you know which investor can align with your vision?

Proven Tips to Find the Right Investors That Work for You

Not all capital is created equal, and finding investors who align with your vision and values can make the difference between sustainable success and constant friction. Here are actionable tips to find the right investors aligned with your vision:

1. Match Investor Type to Your Stage

Choose investors based on where your business is today, not where you want it to be tomorrow.

- For Early Validation: Target angel investors who offer flexibility and mentorship but understand their follow-on limitations.

- For Proven Traction: Approach VCs who can provide substantial capital and networks, but be prepared for their growth timeline expectations.

- For Strategic Partnerships: Consider corporate investors who offer market access, knowing their priorities may shift with parent company strategies.

2. Research Beyond the Money

Money is just the entry ticket, so evaluate what else they bring to your growth story.

- Check Their Network Quality: Ask directly about their ability to introduce you to key customers, talent, and strategic partners.

- Verify Industry Experience: Look for investors who have backed similar businesses and understand your market dynamics.

- Understand Their Support Style: Determine whether they're hands-on mentors or passive observers, then match this to your needs.

- Review Portfolio Success: Study their track record with companies at your stage and in your sector.

3. Test Cultural Alignment Before Committing

Compatibility matters as much as capability when you're building long-term partnerships.

- Meet Portfolio Founders: Ask current and former portfolio companies about their actual experience working with the investor.

- Observe Decision-Making: Pay attention to how quickly and transparently they communicate during the due diligence process.

- Assess Communication Style: Ensure their feedback approach and meeting cadence match your preferred working style.

- Evaluate Long-term Commitment: Understand their fund timeline and how that aligns with your business-building horizon.

4. Spot and Avoid Red Flags

Some warning signs should immediately disqualify potential investors from consideration.

- Business Model Confusion: Skip investors who can't grasp or articulate your value proposition after your pitch.

- Unrealistic Pressure: Avoid those pushing for aggressive timelines that compromise your operational foundation.

- Control Issues: Walk away from investors demanding excessive board control or unfavorable decision-making rights.

- Poor References: Never ignore negative feedback from their portfolio companies—it predicts your future experience.

Take time to find those who genuinely believe in your vision and can contribute beyond capital. Strategic partners like the S45 understand the unique challenges that MSME founders face and help you amplify your strengths, which makes them different from traditional investors.

Where S45 Fits in Your Investor Search

S45 serves MSME founders who want to scale sustainably without losing their business identity.

Our Approach

- Partnership Over Hierarchy: We walk beside founders, never above them. Your vision drives decisions; we provide support and expertise.

- Capital + Expertise: Beyond funding, we offer hands-on guidance in operations, market expansion, and team building from operators who've scaled businesses.

- Sustainable Growth Focus: We help you build lasting value rather than pursuing aggressive growth that compromises your foundation.

Ideal Partnership Fit

We would be a good fit for you if you're:

- Building a business for long-term value creation

- Looking for strategic guidance alongside capital

- Committed to sustainable growth practices

- Seeking partners who understand Indian business culture

Ready to explore how S45 can support your growth journey? Let's discuss how we can help you scale while staying true to your entrepreneurial vision.