Key Takeaways

- SME IPOs allow small and medium enterprises to raise capital through public listing.

- They are listed on specialized platforms like NSE Emerge and BSE SME.

- Higher lot sizes make them less accessible to very small investors.

- Potential returns are high but come with greater risk.

- Thorough research is important before investing in SME IPOs.

What if the next big investment opportunity isn’t in large-cap giants but in fast-growing smaller companies?

SME IPOs in India are drawing more attention than ever, with strong listing gains and rising investor interest. The BSE SME platform alone has helped companies raise Rs 10,652 crore, and their combined market value now stands over Rs 1.84 lakh crore. Even more telling, the average SME IPO size since January 2023 has surged to Rs 32 crore, nearly triple the earlier Rs 11 crore average.

This momentum shows how market appetite has shifted. But riding the wave isn’t just about spotting growth; it’s about making decisions that avoid costly missteps. Understanding behavioral finance can give investors the edge, helping them act with clarity instead of emotion.

In this guide, you’ll learn how market psychology shapes SME IPO investing and how to apply those insights for better results.

What Is an SME IPO in India?

A Small and Medium Enterprise (SME) is a business with limited revenue, workforce, and scale, yet strong growth potential. An Initial Public Offering (IPO) is when a company sells its shares to the public for the first time. When such an offering comes from an SME, it’s known as an SME IPO.

In India, SME IPOs are listed on dedicated platforms like NSE Emerge and BSE SME, designed to provide smaller businesses with access to capital markets while ensuring lighter compliance compared to the main board.

Eligibility norms generally include:

- Profitable track record of at least 3 years

- Paid-up capital of not more than ₹25 crores

- A minimum net tangible assets of ₹1.5 crore

- Companies registered under the Companies Act of 1956

- Company promoters must align with the regulatory and disciplinary compliance

The listing process involves appointing a merchant banker, due diligence, regulatory approvals, and finally, opening the IPO for public subscription.

SME IPOs blend the agility of small businesses with the visibility of public markets, creating unique opportunities for investors seeking early-stage potential.

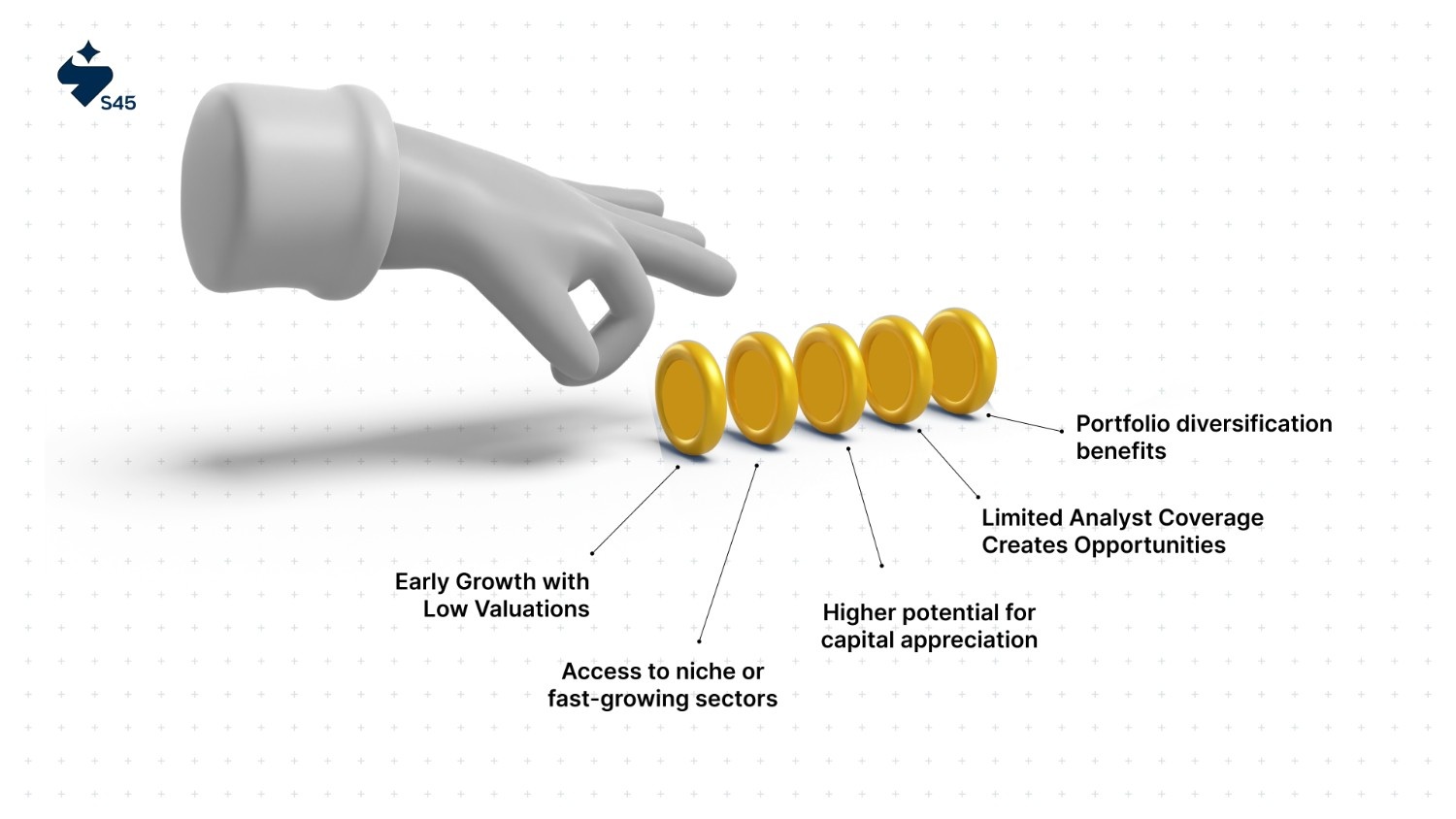

Why do SME IPOs Appeal to Investors?

SME IPOs offer a rare mix of accessibility and growth potential. They let investors participate in businesses that are still expanding and shaping their markets. These opportunities often come before heavy institutional involvement, giving early participants more room for returns.

The appeal lies in several clear advantages:

- Early-stage growth potential with lower entry valuations

SMEs often list at valuations lower than large companies. Investors can buy into growth stories at an earlier stage, before prices reflect the company’s full potential. If the business expands as planned, the upside can be substantial.

- Access to niche or fast-growing sectors

Many SMEs operate in specialized or emerging industries. These sectors may grow faster than the overall market, offering investors exposure to trends that bigger companies may not serve.

However, platforms like S45 often highlight such high-growth SME opportunities, giving founders and investors clearer visibility into untapped sectors. It can make them strong long-term portfolio additions.

- Higher potential for capital appreciation

When an SME succeeds, the impact on its share price can be dramatic. Smaller businesses can scale quickly, and even moderate earnings growth may lead to sharp increases in market value, boosting investor returns.

- Limited analyst coverage leads to more opportunities for informed investors

SME stocks receive less attention from market analysts. It gives diligent investors a chance to spot value before it becomes widely recognized. Informed decisions can create an edge over the broader market.

- Portfolio diversification benefits

Adding SME stocks to a portfolio reduces over-reliance on large-cap companies. Their performance often follows different patterns, helping spread risk and create a more balanced investment mix.

SME IPOs attract those seeking growth, variety, and a competitive edge in their portfolio. Building on this appeal, the market is also being shaped by specific trends worth noting.

What Drives SME IPO Popularity?

SME IPOs have gained remarkable traction in recent years, backed by favourable market shifts and regulatory support. From policy reforms to technological ease of participation, multiple factors are drawing both companies and investors to the SME exchanges. The result is a lively ecosystem with higher activity and visibility.

Here are the most influential trends shaping this momentum:

- Government and SEBI policies encouraging SME listings

Regulatory bodies have introduced relaxed norms, tax incentives, and simplified disclosure requirements for SMEs. SEBI’s customized frameworks for SME exchanges reduce compliance burdens while maintaining investor protection.

This supportive environment makes it easier for smaller businesses to raise capital, while investors gain access to transparent, structured investment opportunities.

- Surge in retail investor participation post-pandemic

The pandemic accelerated digital adoption, leading to a wave of first-time investors entering equity markets. Many are seeking high-growth opportunities outside large-cap stocks, and SME IPOs fit this profile.

Retail participation is further boosted by lower ticket sizes, straightforward online application processes, and stories of strong listing gains.

- Strong performance of recent SME IPOs

Several SME IPOs have delivered impressive returns shortly after listing, building trust and attracting more interest. This performance trend has generated positive word-of-mouth, motivating both seasoned and new investors to explore SME offerings.

High subscription rates in recent issues reflect growing confidence in this asset class.

- Sectoral booms (manufacturing, tech, green energy, etc.)

SME IPOs often represent emerging sectors that are experiencing rapid growth. From precision manufacturing and IT services to renewable energy, these industries offer investors exposure to future-ready businesses.

Many SMEs operate in niche markets, providing a unique growth story compared to broader market options.

- Easier access through online IPO platforms and UPI

Applying for IPOs has become simpler and faster with digital platforms and UPI-based payments. This convenience lowers barriers to participation, especially for retail investors in smaller towns and cities.

Increased accessibility ensures that SMEs can attract a wider pool of investors across the country.

In essence, a combination of policy tailwinds, sector growth, and digital ease is fueling SME IPO momentum. This growth, however, comes with its own complexities and risks that demand closer examination in the context of market realities.

Major Risks and Hurdles in SME IPO Investments

While SME IPOs can offer exciting growth opportunities, they also come with unique risks that investors must weigh carefully. These challenges are often different from those in mainboard IPOs and require a more cautious, research-driven approach. Understanding them can help investors make informed decisions and secure their capital.

Below are the key challenges and how to address them effectively:

- Lower liquidity compared to mainboard IPOs

SME shares often see lower trading volumes than mainboard stocks. It means selling your shares quickly, especially during market downturns, can be difficult. To overcome this, investors should be prepared for a longer holding period and focus on companies with strong fundamentals that can sustain value over time.

- Limited operational history and financial track record

Many SMEs are relatively young businesses, with shorter operating histories and less consistent financial performance. It makes it harder to assess stability. The best way to manage this risk is to examine management quality, industry potential, and audited financials, while also comparing performance with sector peers.

- Higher volatility

SME IPO stocks can see sharp price swings due to lower liquidity and market sentiment. Such volatility can test investor patience. To reduce exposure, consider investing smaller amounts across multiple SME IPOs, diversifying sectors, and focusing on businesses with proven demand for their products or services.

- Need for in-depth due diligence

Relying solely on promotional material or IPO hype can be dangerous. SMEs often operate in niche markets that require a deeper understanding. Investors should study the red herring prospectus, industry reports, competitor performance, and any available research before committing funds.

- Limited analyst coverage and public information

Unlike large-cap companies, SME IPOs rarely get extensive analyst coverage. Less publicly available research and fewer market opinions to guide decisions. To overcome this, investors must proactively seek information from company disclosures, industry associations, and credible financial media.

SME IPOs are not for the uninformed investor. They demand patience, deeper research, and a readiness to handle higher uncertainty. Those willing to put in the effort, however, can find opportunities with strong potential returns. This is where evaluation skills become essential.

How to Evaluate an SME IPO Before Investing?

Smart SME IPO investing starts with thorough homework. Beyond the hype, investors need to focus on facts, fundamentals, and long-term viability. Careful evaluation can help you spot genuine opportunities and avoid overvalued or risky plays. It involves looking at financials, leadership quality, market positioning, and sector dynamics.

Here are the most important factors worth examining:

- Check financial health and debt levels

A strong balance sheet indicates resilience. Look for steady revenue growth, healthy profit margins, and manageable debt. Excessive borrowing can strain cash flow and affect future expansion. Analyzing recent financial statements helps determine if the company is financially stable enough to withstand market pressures.

- Assess promoter track record and shareholding

Promoters shape the company’s vision and execution. A solid history of delivering results builds investor confidence. High promoter shareholding often signals commitment, while frequent stake dilution may raise questions. Check if their past ventures were successful and if they’ve maintained ethical corporate practices.

- Compare valuations with peers

A fair valuation ensures you’re not overpaying for growth potential. Compare the company’s price-to-earnings and price-to-book ratios with similar businesses in the sector. A significantly higher valuation may mean inflated expectations, while a lower one could signal hidden challenges or a potential bargain.

- Read the DRHP for risks and growth plans

The Draft Red Herring Prospectus is a goldmine of information. It reveals potential risks, business models, funding needs, and expansion strategies. Reading it thoroughly helps you understand both opportunities and pitfalls, allowing you to decide whether the IPO aligns with your investment goals.

- Analyze sector outlook

A promising sector can amplify a company’s growth. Study market demand, competitive pressures, and regulatory factors. Sectors with strong blows often provide better long-term returns, while stagnating industries may limit upside despite strong individual company performance.

Evaluating an SME IPO is part analysis, part foresight. When done right, it increases your odds of backing the right company at the right time, building a strong base for potential gains. This is where having the right tools and insights can give you an edge.

How S45 Promotes High-Performing Indian SMEs to Go Bigger?

S45 is a growth platform designed to help India’s most ambitious SMEs scale faster. We offer strategic insights, networking opportunities, and curated resources to accelerate growth, improve governance, and prepare businesses for transformative milestones like IPOs or international expansion.

S45 is built for SMEs with a proven track record that crosses ₹100 Cr+ in revenue or ₹10 Cr+ in annual profit. These businesses already have a strong market presence and are ready to explore structured growth opportunities.

S45’s club for founders is an exclusive network where SME founders connect, learn, and share. The club facilitates closed-door discussions with industry leaders, provides access to capital, and unlocks mentorship from seasoned entrepreneurs and investors.

If your SME is ready to scale beyond limits, S45 can help you get there faster and smarter. Join S45 today and open growth opportunities that top-performing businesses trust.

Conclusion

SME IPOs are emerging as one of the most exciting investment trends in India, offering investors the chance to participate in the growth of agile, innovative businesses. Their appeal lies in high-growth potential, favourable valuations, and the opportunity to back sector leaders early. This surge is driven by stronger SME performance, supportive government policies, and increasing investor awareness.

However, as with any investment, caution is important. Evaluating business fundamentals, sector dynamics, and leadership vision is essential before committing capital. For SMEs, preparing for an IPO requires strong governance, scalable operations, and strategic positioning, areas where platforms like S45 help high-performing businesses excel.

Could SME IPOs be your next big portfolio win? Understand the trend, do your homework, and take the first step towards informed, high-potential investing. Connect with S45 today!

Frequently Asked Questions

1. Can anyone invest in an SME IPO?

Yes, but SME IPOs are listed on platforms like NSE Emerge and BSE SME, which have a minimum investment lot size, often higher than mainboard IPOs. Investors must have a demat account and meet the lot size requirement to participate effectively.

2. Are SME IPOs riskier than regular IPOs?

Generally, yes. SMEs may have limited financial history, smaller market share, and higher volatility. These factors make them more vulnerable to economic changes. However, thorough research, analyzing financials, and understanding the sector can help mitigate risks and improve decision-making before investing in SME IPOs.

3. How long should I hold SME IPO shares?

Holding periods vary depending on company performance and market conditions. Many investors choose a medium-to-long-term horizon of three to five years to allow the business to grow and valuations to stabilize. Short-term flips can be risky due to potential post-listing volatility.

4. Do SME IPOs give better returns?

They can, but returns depend on business growth, sector performance, and market sentiment. Some SME IPOs can deliver multi-bagger gains, while others underperform. Success often comes from choosing fundamentally strong companies with clear growth plans and sustainable business models, backed by capable promoters and healthy financials.

5. What documents are needed to apply for an SME IPO?

You’ll need a valid PAN card, a demat account, and bank account details linked with ASBA (Application Supported by Blocked Amount). The process is similar to a mainboard IPO, but ensure you understand the lot size and platform requirements before applying.