TL;DR (Key Takeaways)

- Angel investors use personal funds to support early-stage startups with flexible terms.

- Venture capitalists manage pooled funds to invest in scalable growth-stage businesses.

- Angel funding suits idea validation while VC funding supports expansion and market leadership.

- Choosing the right investor depends on funding needs, business stage, and growth goals.

- Understanding their differences prevents founders from risking control or facing misaligned expectations.

Do you know which funding option suits your startup’s early goals, Angel Investors or Venture Capitalists (VCs)?

Choosing the right one can shape your business journey. India’s startup ecosystem continues to grow steadily. In the first quarter of 2025 alone, Indian startups raised $3.1 billion across 232 deals, a 41% increase from the same period last year. This growth highlights the importance of understanding funding options before approaching investors.

Angel investors and venture capitalists may seem similar, but their approaches, expectations, and support differ. Understanding the difference between angel investors and venture capitalists helps you plan funding stages wisely and protect your ownership.

In this guide, founders will learn the meaning, differences, advantages, limitations, and when to choose between angel investors and venture capitalists to build a strong funding strategy.

Who are Angel Investors?

Angel investors are individuals who invest their own money in startups. They usually fund early-stage businesses needing quick capital to build products, teams, or market reach. Angel investors often come from business backgrounds and provide both money and guidance to founders.

They typically invest between ₹10 lakh to ₹2 crore, depending on the startup's stage and their risk appetite. This funding is useful when your business is too new for venture capital firms but needs more than personal savings or family contributions.

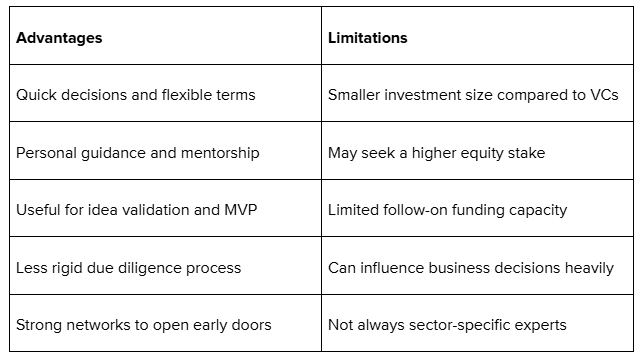

Here are their advantages and limitations:

Ola, InMob, and Unacademy are some of the examples of Indian startups funded by angels before raising VC funds. Kunal Shah, Anupam Mittal, and Ramakant Sharma are some of the well-known angel investors in India.

Angel investors play an important role in helping startups move from idea to market readiness. Understanding them helps you decide when to seek their support or wait for structured VC funding.

Who are Venture Capitalists?

Venture capitalists are firms or funds that invest pooled money from investors into high-growth startups. They aim for equity returns by helping businesses scale quickly. VCs often manage large funds and follow structured processes before investing.

VC funds work by collecting money from institutions, HNIs, and family offices. They invest in promising startups, hold equity, and exit through acquisitions or IPOs for returns. Their involvement goes beyond money, offering strategic guidance and connections.

They typically invest from ₹2 crore to ₹100+ crore or more. Popular sectors include technology, fintech, healthcare, and consumer brands. VCs usually come in at seed, Series A, or later stages to accelerate growth.

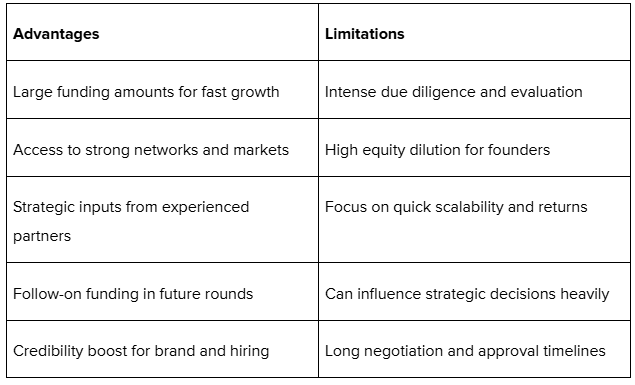

Here are their advantages and limitations:

Some of the top VC funds in India include Accel India, Matrix Partners, and Nexus Venture Partners.

Examples of Indian startups funded by VCs:

- Flipkart: Received VC funding from Accel and Tiger Global to grow into an e-commerce leader.

- BYJU’s: Raised large VC rounds to scale EdTech operations across India and globally.

- Swiggy: Backed by VCs like Naspers and Accel to expand food delivery nationwide.

Understanding venture capitalists helps you plan funding routes and negotiate partnerships aligned with your business goals. Now, let’s have a look at the clear difference between angel investors and venture capitalists.

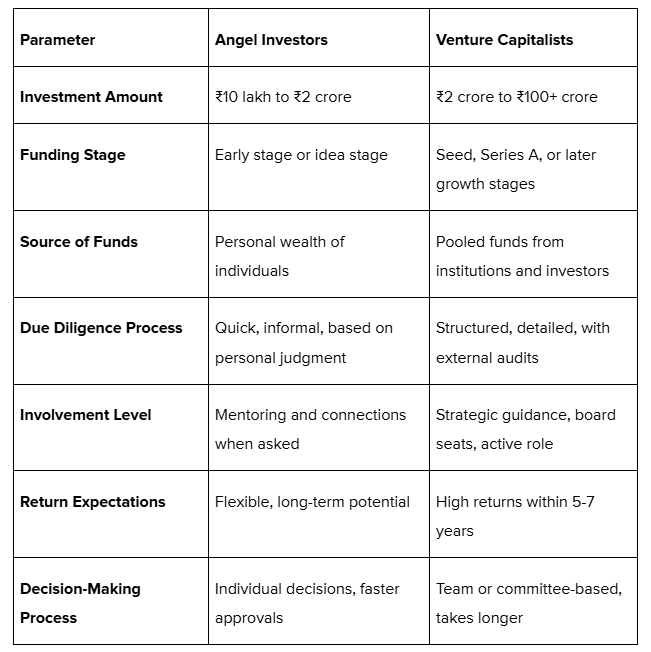

Key Differences Between Angel Investors and Venture Capitalists

Choosing the right investor depends on your business stage, funding needs, and growth plans. Angel investors and venture capitalists differ in how they invest, their expectations, and their involvement. Knowing these differences helps you prepare better and approach them with clarity.

Here is a clear comparison:

Understanding these differences helps you align your funding strategy with business goals and investor expectations for smoother growth partnerships. For many scaling SMEs, this decision also intersects with platforms like S45, which are designed to prepare growth-ready businesses for the right type of capital at the right stage.

Choosing between angels and VCs depends on where you stand today and how you plan to grow tomorrow.

When Should Founders Choose Angel Investors?

Early-stage businesses often need quick funds, flexible terms, and strong guidance. Angel investors suit founders seeking mentorship, market access, or networks alongside funding. They usually invest their own money, making decisions faster with fewer formalities. It can help founders act swiftly during critical launch phases.

Choosing angel investors works best when:

- You need funds to build a prototype or test your idea.

- Your business is not yet ready for VC-level due diligence.

- Personalized mentorship or industry networks can accelerate your launch.

- You want minimal dilution with early flexible capital.

- Your revenue model is still evolving and requires strategic validation.

Choosing angel investors brings growth and mentorship, but needs caution on equity given up early. However, understanding when to approach VCs is just as important for scaling your business vision ahead.

When Should Founders Choose Venture Capitalists?

Venture capital is best suited for startups ready to scale operations quickly. Founders with a proven product-market fit, early traction, or growing revenues can benefit. VCs bring structured funding, strategic connections, and market credibility but expect high-growth returns within defined timelines.

Consider VC funding when:

- Your business is in a growth stage, needing large-scale expansion funds.

- You seek structured capital with strategic advice for market dominance.

- There is a need for experienced board members to guide decisions.

- You plan for acquisitions, geographic expansion, or tech upgrades.

- Your model has potential for strong returns within five to seven years.

VC funding fuels rapid scaling but comes with equity dilution and growth pressures. Understanding how equity advisors like S45 support these funding decisions can keep your journey balanced and goal-focused.

How S45 Supports You in Choosing the Right Funding Partner?

Choosing between angel investors and venture capitalists can shape your business journey. S45 guides you through these choices with clarity. Our equity advisory approach focuses on aligning funding decisions with your goals and values. We analyze your stage, needs, and risk appetite before advising on funding options.

Our community of founders plan funding strategies that balance growth and control. Our team brings insights from working with manufacturing, trading, and early-stage businesses across India. It ensures you understand each investor’s expectations and choose partners who match your business vision.

S45’s founder-focused philosophy ensures decisions build long-term value, not just short-term capital. If you want practical guidance to select the right funding partner, connect with S45 for clear, honest support. We help build clarity as you plan your funding journey, leading to sustainable growth decisions.

Conclusion

Angel investors and venture capitalists both fuel business growth, but in different ways. Angels invest personal funds at early stages, while VCs use pooled funds for scaling businesses. Key differences include funding size, involvement levels, decision-making processes, and return expectations. Knowing these helps you choose with confidence.

For Indian founders, angels are ideal when starting up with new ideas, limited proof, and the need for mentorship. VCs suit you when your business has traction, needs structured scaling capital, and can align with institutional expectations. The right choice depends on your goals, stage, and risk approach.

Funding decisions can feel complex. S45 stands beside founders with clarity on equity, funding partners, and growth planning. Are you evaluating your funding options today? Connect with S45 for honest, strategic guidance that ensures your choices align with your long-term business vision and growth ambitions.

Frequently Asked Questions

1. What is the main difference between angel investors and venture capitalists?

Angel investors use their personal money to fund startups at very early stages. Venture capitalists manage pooled funds from institutions and invest in businesses that have shown some growth. Angels provide mentorship with money, while VCs focus on scaling returns and have structured investment processes.

2. Do angel investors take equity?

Yes, angel investors usually take equity in exchange for their funding. They invest at early stages when risks are high but valuations are low. This equity stake gives them ownership benefits if the business grows well. Terms depend on negotiations, business potential, and investor expectations.

3. Why do startups prefer venture capitalists?

Startups prefer venture capitalists when they need large funds to scale quickly. VCs bring capital and market networks, team-building support, and credibility to attract more investors. However, they expect strong growth, structured governance, and returns within defined timelines to match fund goals.

4. Is it better to get funding from angel investors or venture capitalists?

It depends on your business stage and needs. Early-stage startups benefit from angels who take higher risks and provide mentorship. Growth-stage businesses needing large funds, professional oversight, and structured scaling prefer VCs. Align your choice with funding size, ownership goals, and long-term growth plans.

5. How much do angel investors typically invest in India?

In India, angel investors typically invest between ₹10 lakh to ₹2 crore per startup. The amount depends on the investor, business model, founder credibility, and market potential. Some angel networks pool funds to invest higher amounts collectively, supporting startups with both capital and mentorship.